Latin America’s capital markets could be on the verge of transformation as tokenisation emerges as a solution to longstanding inefficiencies, according to a new report from Bitfinex Securities. By minting real-world assets (RWA) on blockchain, the region may boost liquidity, cut costs, and expand investor access, potentially unlocking trillions of dollars in new opportunities.

Liquidity Latency and Market Barriers

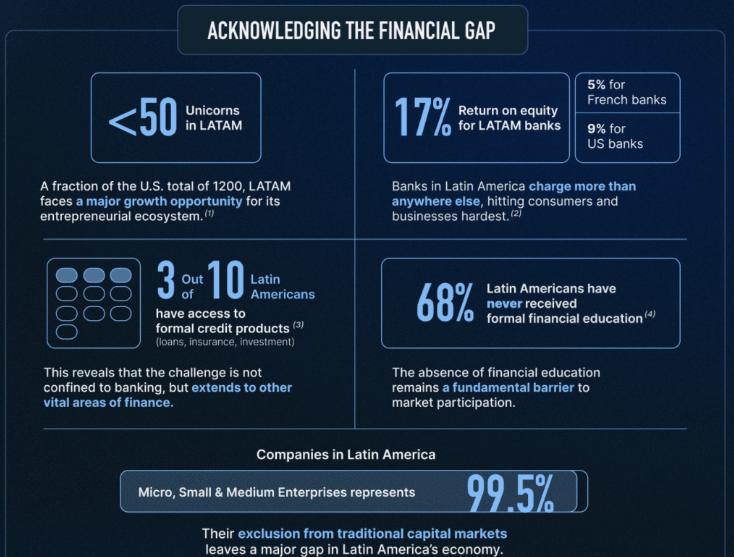

Latin America’s capital markets face persistent obstacles, ranging from high fees and complex regulations to technological barriers and significant startup costs. These inefficiencies have contributed to what Bitfinex calls “liquidity latency” the slowdown of investment and capital flow into regional markets.

The Bitfinex Securities Market Inclusion report, released on Thursday, argues that tokenisation could address these challenges. By digitising financial products and recording them immutably on blockchain, tokenisation enhances transparency and accessibility while reducing operational frictions.

Cutting Costs and Accelerating Market Access

Bitfinex Securities highlighted significant efficiency gains that tokenisation can deliver. Financial products issued on blockchain can lower issuance costs for capital raises by up to 4% and reduce listing times by as much as 90 days. These efficiencies could enable businesses, particularly in emerging economies, to raise capital more quickly and at lower cost.

“Tokenisation represents the first genuine opportunity in generations to rethink finance,” said Jesse Knutson, head of operations at Bitfinex Securities. “It lowers costs, accelerates access, and creates a more direct connection between issuers and investors.”

The streamlined process could also expand trading opportunities for investors, while allowing issuers to bypass traditional bottlenecks and connect directly with a broader pool of capital providers.

Removing Barriers in Developing Economies

Paolo Ardoino, CEO of Tether and chief technology officer of Bitfinex Securities, emphasised tokenisation’s role in levelling the playing field for businesses in developing markets.

“For decades, businesses and individuals, particularly in emerging economies and industries, have struggled to access capital through legacy markets and organisations,” Ardoino noted. “Tokenisation actively removes these barriers.”

He added that tokenised products could unlock capital more efficiently and cost-effectively, offering investors access to higher-yielding instruments that remain backed by compliance and regulatory oversight.

This shift could be particularly impactful in Latin America, where access to stable financial infrastructure has historically been limited. By embracing blockchain-based securities, the region could create more resilient pathways for both issuers and investors.

Early Adoption and Future Outlook

Bitfinex was the first exchange to secure a digital asset service provider licence under El Salvador’s new Digital Assets Issuance Law. This regulatory milestone allowed the platform to issue and enable secondary trading of tokenised assets, with tokenised US Treasury bills among the first products offered.

The broader market potential for tokenisation is considerable. McKinsey estimates that tokenised securities could reach a market size of $1.8 trillion in a base-case scenario and as much as $3 trillion in a bull case by 2030.

Global consulting firms increasingly view tokenisation as a multi-trillion-dollar opportunity, underpinned by the efficiencies and transparency of blockchain technology.

Latin America’s Crypto Momentum

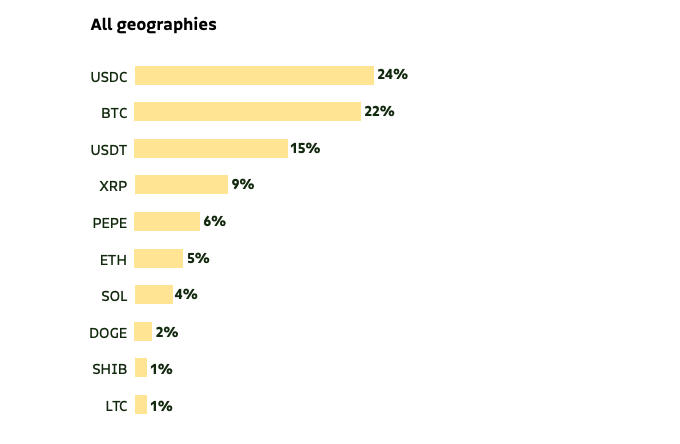

The region’s appetite for digital assets is already growing. Cryptocurrencies and stablecoins have become an essential financial tool, particularly in economies marked by volatility. Stablecoins such as USDt and USDC are now widely used as a store of value, with Bitso reporting that they accounted for 39% of total purchases on its platform in 2024.

This adoption trend indicates that Latin American investors are increasingly comfortable with digital assets, creating fertile ground for tokenised products to gain traction.

A New Era for Finance

Tokenisation could mark a turning point for Latin America’s capital markets. By solving systemic inefficiencies, reducing costs, and expanding access, blockchain-based securities may help overcome the region’s liquidity latency and unlock long-term growth.

As Bitfinex Securities and other industry leaders push forward, tokenisation may represent not just a technological shift but a structural reimagining of finance, one that connects issuers and investors in ways that legacy systems have long struggled to achieve.

Leave a Reply