In a major policy shift, the Trump administration has officially rescinded Biden-era guidance that restricted the inclusion of cryptocurrency and related digital assets in 401(k) retirement plans. This move by the U.S. Department of Labor has reignited a heated debate around the prudence of allowing volatile digital assets like Bitcoin, NFTs, and meme coins into retirement portfolios.

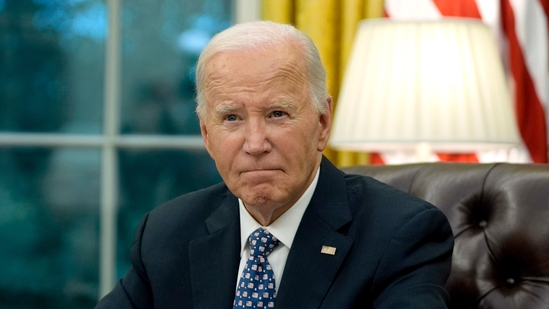

The decision marks a reversal from a more cautious approach adopted under President Biden, which aimed to shield retirement investors from the risks of digital asset exposure. While the Trump administration’s stance does not explicitly endorse crypto in retirement plans, it removes key regulatory barriers, signalling a broader openness to such investment options.

Biden-Era Safeguards Withdrawn

In 2022, the Biden administration’s Labour Department released guidance cautioning employers against offering crypto investments in 401(k) plans. The department advised fiduciaries to exercise “extreme care” when considering such offerings, citing the risk of fraud, theft, and volatile price swings.

At the time, this approach was rooted in concerns over the rapid boom—and subsequent crashes—within the crypto sector. From the collapse of Terra Luna’s stablecoin to high-profile bankruptcies like FTX and Celsius, the “Crypto Winter” of late 2022 was a stark reminder of the asset class’s vulnerability and unpredictability.

Legal and financial experts have pointed to that period as justification for the Biden-era caution. Stephen Hall, legal director at Better Markets, said the previous guidance “likely saved millions of investors from grievous losses,” highlighting the role of federal oversight in preventing reckless exposure to speculative assets.

A Shift Towards ‘Neutrality’

The Trump administration’s reversal of the guidance is not being framed as an endorsement of crypto but rather as a return to neutrality. In its latest compliance assistance bulletin, the Labour Department stated that the “extreme care” standard used by the Biden administration has no basis in the Employee Retirement Income Security Act (ERISA), the governing law for workplace retirement plans.

“Prior to the 2022 release, the Department had usually articulated a neutral approach to particular investment types and strategies,” the bulletin noted. The department now says it is “neither endorsing, nor disapproving of” employers who choose to include digital assets in their plan offerings.

This shift allows fiduciaries more discretion, though it does not absolve them of their responsibilities. ERISA still mandates that employers act prudently and in the best interests of plan participants—a standard that legal experts believe will continue to pose a barrier to widespread adoption of crypto in retirement plans.

Industry Reaction: Applause and Alarm

The policy change has drawn mixed reactions. Crypto advocates view the move as a long-overdue opening for digital assets to be treated on par with other investment classes. President Trump has recently vowed to make the U.S. the “crypto capital of the world” and has even launched his own meme coin, $TRUMP, which has surged in value.

However, fiduciary experts and financial reform advocates have issued strong warnings. Knut Rostad, president of the Institute for the Fiduciary Standard, called the move a “big mistake,” arguing that crypto’s inherent volatility and lack of regulation make it unsuitable for retirement savings.

“As a huge general rule, crypto doesn’t belong in a 401(k), period, end of sentence,” said Rostad. He warned that rescinding the cautionary guidance is akin to replacing a yellow warning light with a green one, potentially misleading employers and investors about the safety of such investments.

What This Means for Retirement Savers

Despite the regulatory shift, experts stress that crypto is far from becoming a staple in retirement plans overnight. Philip Chao, a retirement plan consultant and certified financial planner, noted that fiduciary duty remains intact and that employers could still face legal action if crypto investments in 401(k)s perform poorly.

“In reality, it’s saying we should treat crypto like any other asset,” Chao said. However, he added that many employers are unlikely to jump at the opportunity, especially given the legal uncertainties and historical volatility surrounding digital assets.

Moreover, many financial advisors remain sceptical. The lack of a comprehensive regulatory framework, combined with the technical complexity of digital assets, continues to raise red flags. For now, the move appears more symbolic—a nod to pro-crypto voters and industry players—than a catalyst for immediate widespread change.

A Controversial Opening

The Trump administration’s rollback of Biden-era safeguards for crypto in retirement plans is both significant and controversial. While it removes explicit barriers for employers to offer digital assets in 401(k) plans, it does not provide blanket approval. Fiduciaries must still navigate the legal and ethical responsibilities under ERISA and remain accountable for the outcomes of their investment decisions.

As crypto continues to gain political and economic traction, this policy shift may foreshadow deeper debates about the role of digital assets in traditional finance—and how best to protect long-term savers in a rapidly evolving landscape.

Leave a Reply