World Liberty Financial (WLFI), a cryptocurrency project backed by President-elect Donald Trump, has recently moved a significant amount of Ethereum. In the past 24 hours, WLFI transferred $61.4 million worth of Ethereum, sparking interest among crypto enthusiasts and market watchers. According to blockchain data from Arkham Intelligence, these movements have raised questions about WLFI’s financial strategies and operational management in the volatile world of crypto.

Routine Treasury Management or Strategic Moves?

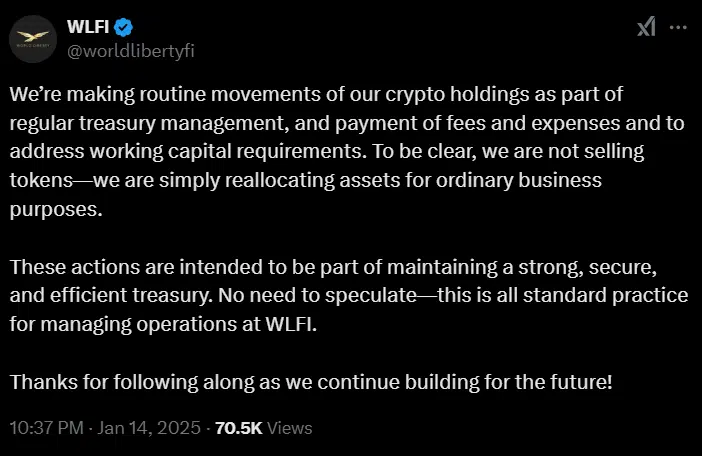

WLFI has been quick to clarify that these large transfers are part of their normal treasury management activities. In a statement posted on X (formerly Twitter), the project explained that the funds were moved to address “working capital requirements” and to cover various “fees and expenses.” The transfers involved multiple wallets, including major crypto exchange platform Coinbase Prime, and were described as standard operational practices.

Importantly, WLFI has emphasized that no tokens were sold during these transfers. This suggests that the project’s decision to move such large sums of crypto is not a sign of panic selling, but rather a routine part of managing its digital assets for future growth. The project has also mentioned that the transfers had no impact on its long-term strategic investments.

Key Transactions and Crypto Balances

Blockchain data reveals several key transactions carried out by WLFI during this period. Among these, the project swapped 103 Wrapped Bitcoin (WBTC) for approximately 3,075 Ethereum (ETH), valued at around $10 million. Additionally, another $59.8 million worth of Ethereum was moved to Coinbase Prime and other wallets.

A significant portion of the transfers also involved Tether (USDT). WLFI used $1.7 million in USDT to acquire 17.62 WBTC at an average price of $96,49 per coin. At its peak in mid-December, WLFI held a balance of $83 million, but by the time of this report, that figure had dropped to $17 million. Despite the decrease, the project insists that these fluctuations are a result of normal treasury management and are in line with the project’s financial strategies.

Unrealized Losses and Long-Term Strategy

Even though WLFI has made significant transfers, the project still faces unrealized losses of approximately $4.8 million. These losses are attributed to the volatility of its portfolio, which includes assets like Ethereum, WBTC, Aave (AAVE), and Chainlink (LINK). The current market downturn has undoubtedly affected the value of these assets, but WLFI has refrained from selling any of them, demonstrating confidence in a long-term investment strategy.

While the project’s short-term holdings have decreased, its reluctance to sell assets indicates a commitment to weathering market fluctuations and holding onto its investments for potential future gains.

Partnership with Ethena Labs and Ecosystem Development

In addition to its treasury movements, WLFI has been actively enhancing its ecosystem. The project recently partnered with Ethena Labs to integrate the sUSDe stablecoin into its Aave system. The stablecoin, supported by borrowed Bitcoin and held on the Ethereum blockchain, is another example of WLFI’s efforts to bolster its financial infrastructure and maintain a competitive edge in the crypto space.

This partnership highlights WLFI’s ongoing commitment to developing innovative solutions and expanding its presence in the DeFi (decentralised finance) sector. By adding new financial products to its ecosystem, WLFI aims to continue building on its success and improve its long-term sustainability.

Leave a Reply