Turkey has announced new anti-money laundering (AML) regulations for cryptocurrency transactions, set to take effect on 25 February 2025. Under the new rules, users conducting transactions exceeding 15,000 Turkish lira (£425) must provide identifying information to crypto service providers, according to the Republic of Turkey’s Official Gazette. Transfers below this threshold remain exempt from these requirements. The regulations draw inspiration from crypto frameworks in major jurisdictions such as the European Union.

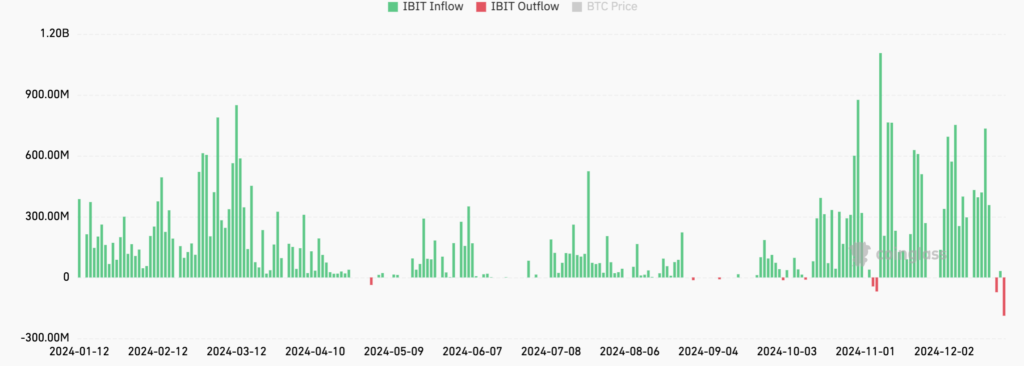

BlackRock’s Bitcoin ETF Sees Record Outflows

BlackRock’s iShares Bitcoin Trust ETF (IBIT) faced its largest-ever single-day outflow on Christmas Eve, with investors withdrawing $188.7 million, according to CoinGlass data. This marked the fourth consecutive trading day of outflows for the 12 U.S.-based Bitcoin exchange-traded funds (ETFs), which collectively recorded $338.4 million in outflows on the same day. Since 19 December, these funds have experienced joint net outflows of $1.52 billion.

Amid this trend, the Bitwise Bitcoin ETF (BITB) was the sole fund to see pre-Christmas inflows, gaining $8.5 million. Meanwhile, Ether ETFs have shown resilience, recording $53.6 million in inflows on 24 December, following a $130.8 million inflow on 23 December.

MicroStrategy Plans $42 Billion Bitcoin Acquisition

MicroStrategy has called a special shareholders meeting to seek approval for increasing authorised shares to support its ambitious $42 billion Bitcoin acquisition strategy, termed the 21/21 Plan. The proposal includes expanding the number of authorised Class A common and preferred shares, enabling greater flexibility for future equity issuances.

Since October, the company has accelerated its Bitcoin purchases, acquiring 42,162 BTC in December alone. As of 22 December, MicroStrategy’s Bitcoin holdings surpassed 444,000 BTC, valued at approximately $43.5 billion at current prices.

Today’s crypto developments highlight Turkey’s move towards stricter regulation, major fluctuations in Bitcoin ETF investments, and MicroStrategy’s aggressive Bitcoin accumulation strategy. These events underline the evolving landscape of the global cryptocurrency market, with regulatory and investment trends continuing to shape its future.

Leave a Reply