For years, global regulators have placed the spotlight on cryptocurrency as a major tool for money laundering. Yet fresh data from the US Financial Crimes Enforcement Network (FinCEN) reveals that traditional banks remain the preferred gateway for criminal funds. Between January 2020 and December 2024, American financial institutions processed $312 billion in suspicious transactions linked to Chinese money laundering networks. Despite this, regulators continue to target crypto, even though illicit blockchain activity accounts for less than 1% of total global laundering.

$312 Billion Laundered Through US Banks

According to FinCEN’s analysis of 137,153 Bank Secrecy Act reports, Chinese crime syndicates have built sophisticated ties with Mexico-based drug cartels. Together, they exploit currency restrictions in both countries: Mexico prevents large dollar deposits in its banks, while China imposes strict controls on overseas transfers. This loophole allows cartels to sell their illicit dollars to wealthy Chinese nationals who are desperate to move money out of Beijing’s grip.

The network extends well beyond narcotics. FinCEN flagged $53.7 billion in suspicious real estate purchases, alongside reports of money flowing into human trafficking and even fraudulent healthcare centres in New York. One example cited involved $766 million laundered through adult day care centres, highlighting how far-reaching these schemes can be.

Banks Handle the Bulk, Not Crypto

Of the $312 billion uncovered, US banks alone accounted for $246 billion, dwarfing the $42 billion processed by money service businesses and the $23 billion moved through securities firms. On average, these laundering operations channelled $62 billion per year through American banks.

This is not the first time major banks have been implicated in large-scale laundering. Wachovia Bank allowed $350 billion in Mexican cartel money to move through its accounts between 2007 and 2010, receiving only a modest $160 million fine. Danske Bank processed $228 billion in Russian funds despite repeated warnings. HSBC, meanwhile, paid $1.9 billion in 2012 after drug cartels moved hundreds of millions through its branches using specially designed cash boxes.

More recently, TD Bank was forced to pay over $3 billion after investigators found it had been used to launder $470 million through Chinese networks in New York and New Jersey. These cases reveal a clear pattern: traditional banks remain deeply exposed to criminal exploitation, yet the penalties they face are often small compared to the scale of the crime.

Crypto’s Small Share of Laundering

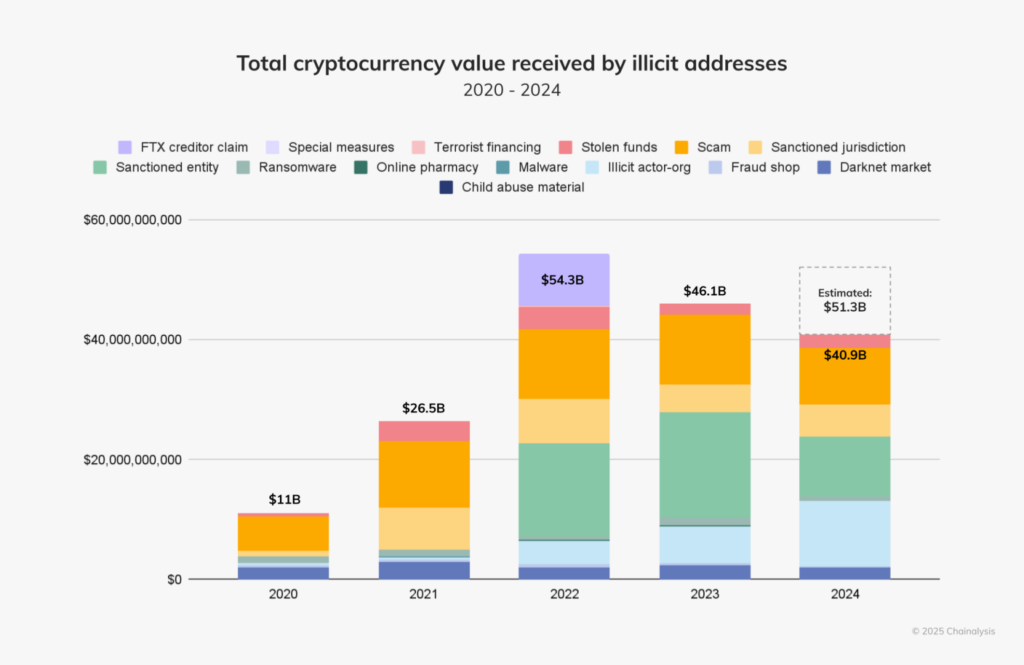

In sharp contrast, blockchain analytics firm Chainalysis estimates that illicit crypto transactions totalled $189 billion over five years, a fraction of the trillions laundered annually through global banks. In 2024, crypto-related criminal activity reached $51.3 billion, only a sliver compared to the $312 billion flagged in the US banking system in the same year.

TRM Labs, another blockchain intelligence company, places crypto’s share of global money laundering at less than 1%. Despite this, regulators have made cryptocurrency their main enforcement target. Binance Australia was recently ordered to appoint an external auditor after AUSTRAC raised “serious concerns” over its compliance controls. French authorities are investigating Binance, while European regulators are reviewing OKX for alleged laundering of $100 million.

Meanwhile, AUSTRAC in Australia has expanded its crackdown on remittance and crypto providers, cancelling or refusing renewals for nine companies. By comparison, banks implicated in hundreds of billions of dollars in laundering often escape with fines that barely dent their profits.

The Regulatory Disparity

The contrast raises questions about regulatory priorities. Senator Elizabeth Warren has repeatedly claimed that bad actors are “increasingly turning to cryptocurrency” to launder funds. Yet FinCEN’s own data shows that Chinese networks overwhelmingly rely on banks, not crypto, to move money across borders.

Part of the answer may lie in perception. Crypto is new, decentralised, and harder for regulators to control, making it an easy political target. Banks, on the other hand, remain central pillars of the global financial system. Punishing them too severely risks financial instability, so penalties remain limited even when they enable massive flows of criminal money.

The numbers speak for themselves: while crypto faces aggressive scrutiny, traditional banks remain the far larger vehicle for money laundering. With hundreds of billions flowing through regulated banking channels each year, the focus on crypto seems more about optics than scale. Unless regulators confront the vulnerabilities in the banking system, criminal organisations will continue to exploit them, regardless of how tightly crypto is policed.

Leave a Reply