United States spot Bitcoin exchange-traded funds showed early signs of stabilisation after a difficult week, recording $75.4 million in net inflows on Wednesday. The rebound came as Bitcoin briefly reclaimed the $92,000 mark following several days of consistent price declines.

Inflows Return After Persistent Redemptions

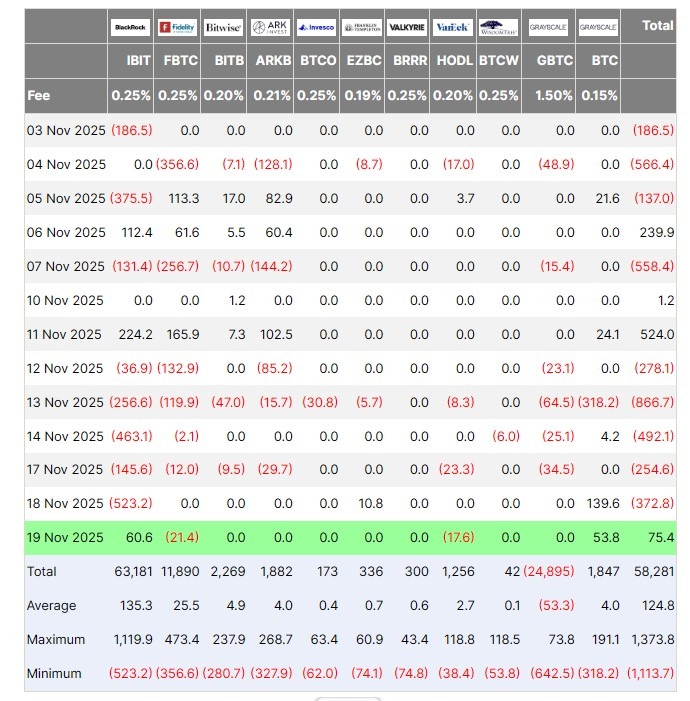

Farside Investors data confirmed that the inflow marked the end of a five-day streak of outflows across US spot Bitcoin ETFs. BlackRock’s iShares Bitcoin Trust led the recovery with $60.6 million entering the fund. This figure remains small compared with Tuesday’s large $523 million withdrawal, yet it reflects renewed interest during a volatile market phase.

The Grayscale Bitcoin Mini Trust also contributed positively, attracting $53.8 million in new capital. At the same time, funds operated by Fidelity and VanEck posted a combined $39 million in outflows, showing that investor sentiment remains mixed.

Bitcoin Price Recovery Supports ETF Sentiment

The return of inflows aligned with Bitcoin’s brief climb back to $92,000 on Wednesday. CoinGecko data revealed that the asset later dipped to $88,500 on Thursday before recovering to around $91,700 at the time of writing.

The move suggested tentative stabilisation following several sharp declines earlier in the week.

Nearly $3 Billion Withdrawn in November

Despite Wednesday’s improvement, US spot Bitcoin ETFs continue to face heavy selling pressure in November. Outflows topped $868 million on 13 November and nearly $500 million the following day.

Fidelity’s FBTC recorded some of the largest redemptions, losing $132.9 million and $119.9 million across two consecutive sessions last week. Other issuers, including Bitwise, Ark Invest and Invesco, have also experienced extended stretches of negative flows.

Global data reflects a broader cooling in crypto investment products. Crypto ETPs saw $2 billion in outflows last week, the highest weekly total since February. US products accounted for almost the entire amount.

ETF Sector Heads Towards Worst Month Since Launch

With almost $3 billion already withdrawn this month, the category is on pace to exceed February’s $3.56 billion outflow record.

The continuing redemptions highlight waning investor confidence in the short term, influenced by market uncertainty and profit taking following Bitcoin’s recent highs.

Signs of Stabilisation Emerge

Although the latest inflow figure is modest, it demonstrates that some investors are beginning to re-enter the market. SoSoValue data revealed that ETF trading volume rose to $6.89 billion on Wednesday, up nearly 18 per cent from the previous session.

The higher volume suggests that a segment of the market is buying the dip or positioning ahead of possible year-end developments. While the broader trend continues to show outflows, the latest numbers indicate that sentiment is not universally negative.

Leave a Reply