The United States’ federal debt has soared to an unprecedented $37 trillion, fuelling speculation that swelling deficits and potential money supply expansion could pave the way for Bitcoin to reach $132,000 before the end of 2025.

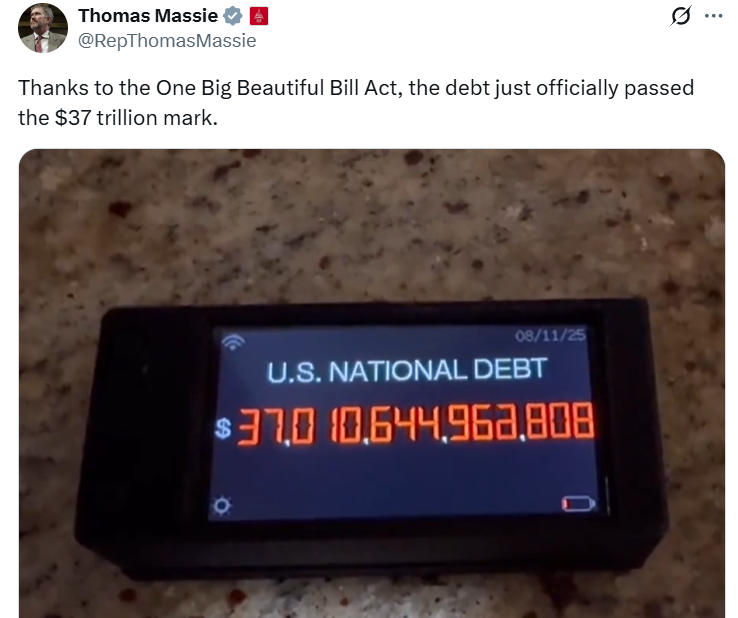

Representative Thomas Massie highlighted the milestone in a post on X, attributing the surge to the recently enacted One Big Beautiful Bill Act. Signed into law by President Donald Trump on 4 July, the legislation was promoted as a measure to reduce federal spending by up to $1.6 trillion. However, critics argue it may have the opposite effect.

Debt Surge and Bitcoin Correlation

According to US Treasury data, the country’s debt has risen sharply from $26.7 trillion in 2020 to over $37 trillion today — a 38% increase in just five years. Over the same period, Bitcoin has gained more than 925%, with analysts claiming a “direct correlation” between the cryptocurrency’s performance and the nation’s rising debt.

Ryan Lee, chief analyst at Bitget crypto exchange, noted that increasing debt levels ultimately affect the American monetary system, as significant sums are channelled into servicing the debt. “The more the debt grows, the higher the likelihood of BTC price soaring to new highs,” Lee said. He also suggested that the US government could one day explore Bitcoin as a tool to address its “massive national debt,” with the “odds stacked in favour of Bitcoin.”

Quantitative Easing and M2 Money Growth

Economists warn that high deficits can pressure policymakers to adopt looser monetary measures, such as quantitative easing (QE) — large-scale bond purchases by central banks designed to inject liquidity into the financial system. Such actions increase the M2 money supply, which includes cash, checking deposits, and easily convertible near-money.

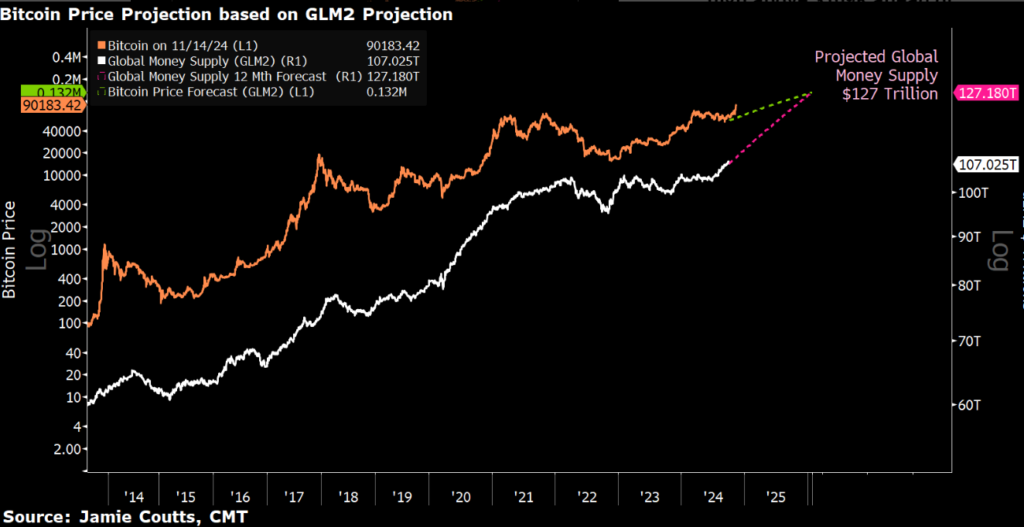

Jamie Coutts, chief crypto analyst at Real Vision, stated that a growing M2 money supply could be a key driver for Bitcoin’s next major rally. Based on historical correlation between fiat supply and Bitcoin prices, Coutts estimated that Bitcoin could reach $132,000 before 2025 closes.

Inflation Concerns Add Momentum

Supporters of Bitcoin argue that the cryptocurrency’s fixed supply makes it an attractive hedge against inflation, especially when central banks expand the money supply. Rising inflation expectations, coupled with a surge in liquidity, are seen as conditions that could propel Bitcoin to new all-time highs.

Elon Musk has also voiced concerns over the US fiscal trajectory, warning in June that the spending bill could push the deficit to $2.5 trillion. This, in turn, may intensify inflationary pressures and spur further money creation.

Higher Predictions from Market Veterans

While the $132,000 forecast appears ambitious, some market figures believe the target is conservative. Arthur Hayes, co-founder of BitMEX and chief investment officer at Maelstrom, has projected Bitcoin could reach as high as $250,000 if the Federal Reserve reintroduces QE in response to inflation. Hayes argues that such a pivot would further erode confidence in fiat currencies, boosting demand for Bitcoin as a store of value.

For now, market watchers remain divided on the precise timeline and scale of the potential rally. However, with debt levels surging and monetary policy under pressure, the stage appears set for significant volatility — and possibly new records — in the cryptocurrency market.

Leave a Reply