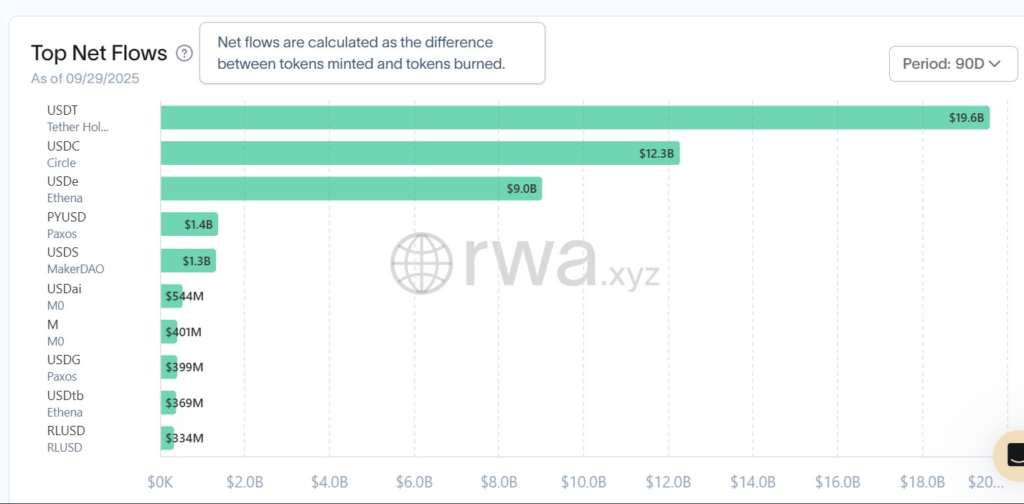

The stablecoin market recorded a massive rebound in the third quarter of 2025, with net inflows soaring to $45.6 billion, a 324% jump from the previous quarter. The surge was led by heavyweights Tether (USDT) and Circle’s USD Coin (USDC), while Ethena’s synthetic stablecoin, USDe, also made a significant mark.

According to data from RWA.xyz, the sharp acceleration in inflows signals resurgent demand for dollar-pegged assets in digital finance, even as broader crypto market conditions remain volatile.

Tether and USDC take the lead

Tether’s USDT, the world’s largest stablecoin, maintained its dominance by capturing $19.6 billion in net inflows over the past 90 days. This marks a continuation of its strong run, following $9.2 billion in inflows during Q2. With a 59% share of the global stablecoin market, Tether remains the undisputed leader.

Circle’s USDC posted an equally striking recovery. After recording just $500 million in Q2 inflows, it grew by $12.3 billion in Q3. The jump underscores renewed confidence in USDC’s regulatory profile and its increasing adoption in institutional and retail payments. Together, USDT and USDC accounted for over two-thirds of total stablecoin inflows in Q3.

Ethena’s USDe rises as a challenger

While the giants held firm, Ethena’s algorithmic stablecoin USDe emerged as the quarter’s standout. The token recorded $9 billion in net inflows, a staggering rise from just $200 million in Q2.

USDe’s growth reflects increasing appetite for synthetic and algorithmic stablecoins that combine decentralisation with dollar stability. Its quick ascent has helped Ethena secure close to 5% of the total stablecoin market, a significant achievement in a space dominated by Tether and Circle.

Other entrants also made meaningful progress. PayPal’s PYUSD logged $1.4 billion in inflows, MakerDAO’s USDS added $1.3 billion, while Ripple’s RLUSD and Ethena’s USDtb showed smaller but steady growth. Collectively, these developments highlight a diversifying market where traditional leaders face growing competition.

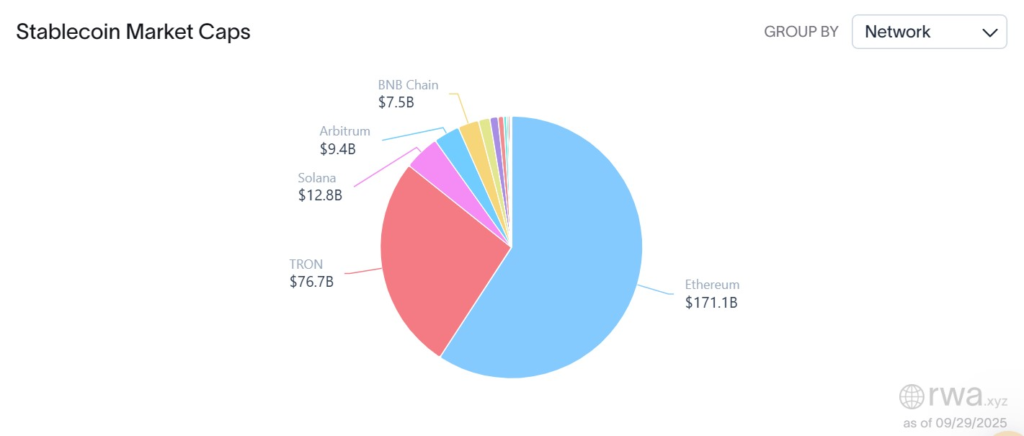

Ethereum holds its stablecoin crown

Ethereum continued to dominate as the primary settlement layer for stablecoins. Data from RWA.xyz shows the network hosting $171 billion in circulating stablecoin supply, far ahead of Tron, which secured second place with $76 billion.

Other networks, including Solana, Arbitrum and BNB Chain, together accounted for $29.7 billion. The figures confirm Ethereum’s enduring role as the bedrock for stablecoin liquidity, particularly for decentralised finance (DeFi) protocols and institutional adoption.

Market grows, but activity dips

While inflows and market capitalisation soared, other ecosystem metrics painted a mixed picture. RWA.xyz recorded a 22.6% drop in monthly active addresses, now at 26 million, compared to the previous month. Meanwhile, transfer volume fell by 11% to $3.17 trillion.

The overall stablecoin market capitalisation, however, expanded sharply to approximately $290 billion, according to DefiLlama data. The combination of higher inflows but weaker activity suggests that while stablecoins are increasingly being minted and held, on-chain usage and transaction frequency remain subdued.

A new phase for stablecoins

The third-quarter boom underscores the growing role of stablecoins in global finance. Investors are increasingly favouring them as a safe harbour for value transfer, liquidity management and cross-border payments. Yet, the surge also raises regulatory questions, with institutions such as Moody’s warning of “cryptoisation” risks in economies where fragmented rules may leave gaps in oversight.

For now, USDT and USDC remain the backbone of the market. But the rise of challengers like Ethena’s USDe signals a new phase, where stablecoin innovation could further reshape the digital asset economy.

Leave a Reply