Bitcoin infrastructure firm Voltage has rolled out a new USD settled revolving credit product that plugs directly into Bitcoin and Lightning payment flows. Called Voltage Credit, the offering allows businesses to send instant Lightning style payments while repaying the borrowed amount in US dollars from a regular bank account or in Bitcoin.

The company says the product is built for finance teams that want speed without the balance sheet complexity of holding crypto. By embedding credit directly into the payment flow, Voltage is positioning the service as a working capital tool rather than a traditional crypto loan.

Send now pay later on Lightning rails

Voltage Credit is designed to give businesses immediate payment finality using the Lightning Network, while deferring settlement to a later date. Instead of pre funding wallets or moving funds between accounts, companies can draw from a revolving line of credit and push payments instantly.

According to Voltage, the structure is meant for chief financial officers and treasury teams that want flexibility similar to card based credit lines but on much faster rails. The company says the credit line can be settled fully in US dollars, which removes the need to keep crypto on the books.

Chief executive officer Graham Krizek said the goal was to bring a familiar financial product into a new payment environment. Revolving credit is widely used, he said, but it has never operated at the speed and global reach that Bitcoin and Lightning make possible.

How it differs from Stripe and Block

Krizek drew a clear contrast between Voltage Credit and products offered by major fintech firms such as Stripe and Block. While those platforms combine faster payments with access to working capital, he said they do not embed a revolving credit facility directly into Lightning based payment flows.

Stripe does not support Lightning payments at all, according to Krizek. In the Block ecosystem, Lightning and credit products operate as separate workflows. Voltage’s approach, he said, lets businesses originate credit and immediately use it for Lightning and stablecoin payments in real time, without manual treasury movements or pre funding.

Voltage acts as the lender of record on its own platform. The company originates and funds the credit lines itself, rather than relying on banks, card networks, or third party fintech partners.

Credit sized by payment flows, not BTC collateral

One of the main differences between Voltage Credit and traditional crypto lending is how the credit risk is assessed. Instead of underwriting against static Bitcoin collateral, Voltage underwrites against payment flows.

Because the company already runs the underlying Bitcoin and Lightning infrastructure for its clients, it has visibility into transaction volumes. Credit limits can be sized and adjusted based on how much a business processes through the platform.

The credit line carries a 12 percent annual percentage yield that accrues daily on outstanding balances. Voltage said it uses a flat platform fee model, rather than transaction based pricing that increases as volumes grow. The structure is aimed at businesses that move large amounts of value and want predictable costs.

From pilot transaction to institutional scale use

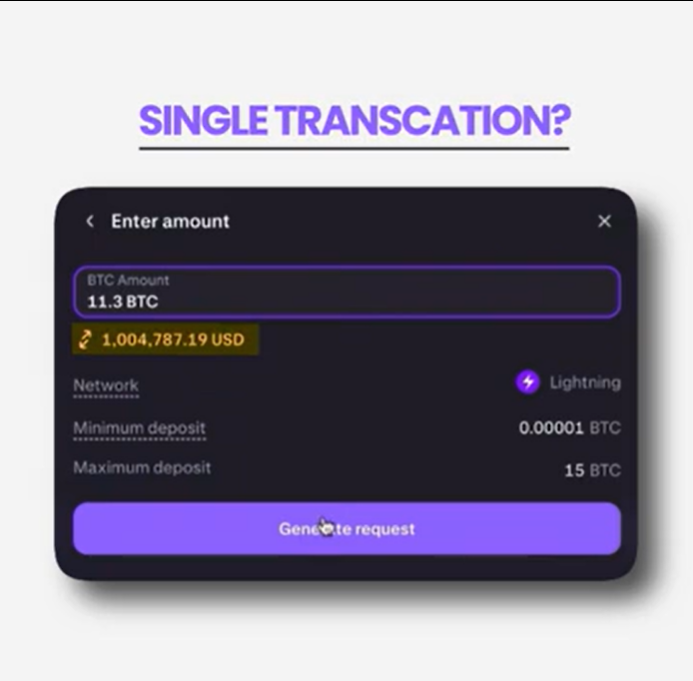

The launch follows Voltage’s involvement in a high profile Lightning payment earlier this month. On Feb. 5, the company supported a one million dollar Lightning Network transaction between Secure Digital Markets and Kraken. The transfer was described as the largest publicly reported Lightning payment to date.

Krizek said the pilot was intended to test whether Lightning could handle institutional sized flows. In his view, the result showed that the network is ready for large scale use cases beyond retail payments.

Data from public dashboards shows that the Lightning Network reached a capacity high of 5,606 BTC in December 2025, driven by adoption from major exchanges and technical improvements. Capacity has eased since then, standing at around 5,121 BTC earlier this week.

Availability and early demand

Voltage Credit is currently available to qualified US headquartered businesses. The company said it can operate in most US states, excluding California, Nevada, North Dakota, Vermont and Washington, D.C., where it does not yet hold lending authorization.

Krizek said early interest has come from crypto exchanges, Bitcoin miners, gaming platforms and payment processors. Many of these firms generate revenue in Bitcoin but face expenses in US dollars. Voltage Credit is positioned as a bridge between those two worlds, helping companies reduce idle capital, avoid forced Bitcoin sales and limit reliance on off ramp services that can be slow or unpredictable.

By combining credit, Bitcoin infrastructure and Lightning payments into a single workflow, Voltage is betting that more businesses will treat Lightning as a serious alternative to legacy payment rails.

Leave a Reply