South Korea’s rich and young investors are turning to crypto over stocks and property, reshaping the country’s financial future.

More than 30% of wealthy South Koreans now prefer crypto over traditional assets like gold or property for long-term value growth, according to a new report from Hana Bank. This marks a significant shift in investment patterns, particularly among younger investors, who are growing disillusioned with conventional financial systems.

The report suggests that if digital assets gain legal recognition and are integrated into the mainstream financial ecosystem, they could trigger a broader transformation in wealth-building strategies.

Young Investors Ditch Stocks

Traditional equities are falling out of favour among young Koreans. By 2023, only 11% of domestic stock market investors were in their 20s — down from 14.9% in 2021. Those in their 30s also saw a dip from 20.9% to 19.4%. Instead, many are turning to U.S. equities and, more notably, to cryptocurrencies.

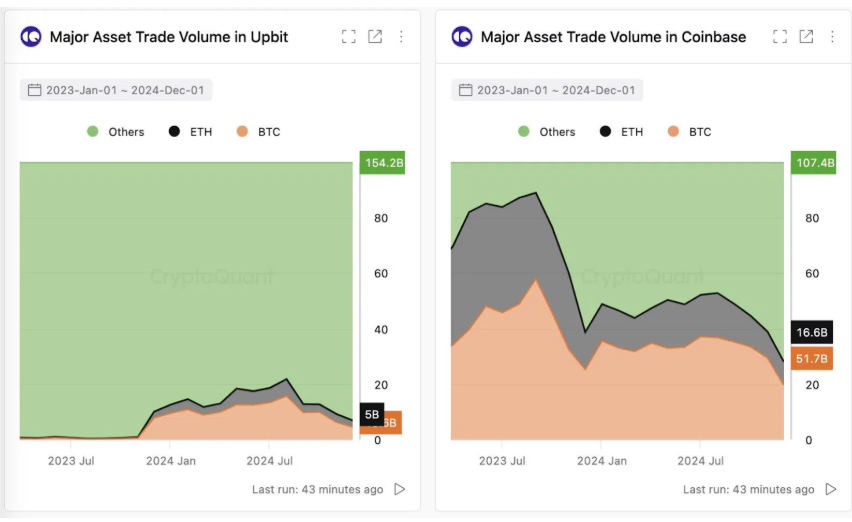

Data from South Korea’s Financial Services Commission shows that nearly 48% of the country’s crypto investors are in their 20s and 30s. Trading volume across the five major Korean exchanges hit a staggering 2.52 quadrillion won (approx. $1.76 trillion) last year.

Wealthy Investors Show Confidence

Over 70% of wealthy individuals investing more than 10 million won (approx. $7,000) have chosen crypto, often allocating double the amount compared to average investors. Despite institutional risks and knowledge gaps, this demographic is reportedly more diligent in researching before investing.

Hana Bank’s researcher Yoon Seon-young noted that this growing interest “signals the maturity of this field,” even if opinions remain divided due to limited regulatory safeguards.

Regulatory Winds of Change

South Korea’s Financial Services Commission plans to introduce a comprehensive crypto investment framework by Q3 2025. This includes potential approvals for universities and nonprofits to sell crypto, institutional guidelines, and a reconsideration of spot ETFs.

Political momentum is also building. Presidential hopeful Hong Joon-pyo has voiced support for deregulation, aligning with younger, crypto-savvy voters. As crypto adoption soars — with nearly 30% of the population reportedly involved — policymakers and financial institutions are being forced to adapt.

Leave a Reply