The White House is considering withdrawing its support for a major cryptocurrency market structure bill after Coinbase stepped back from negotiations warning that the proposed law could harm decentralised finance stablecoins and tokenised assets.

The move has sparked fresh tension between the US administration lawmakers and the digital asset industry highlighting deep divisions over how crypto markets should be regulated.

Administration anger over Coinbase decision

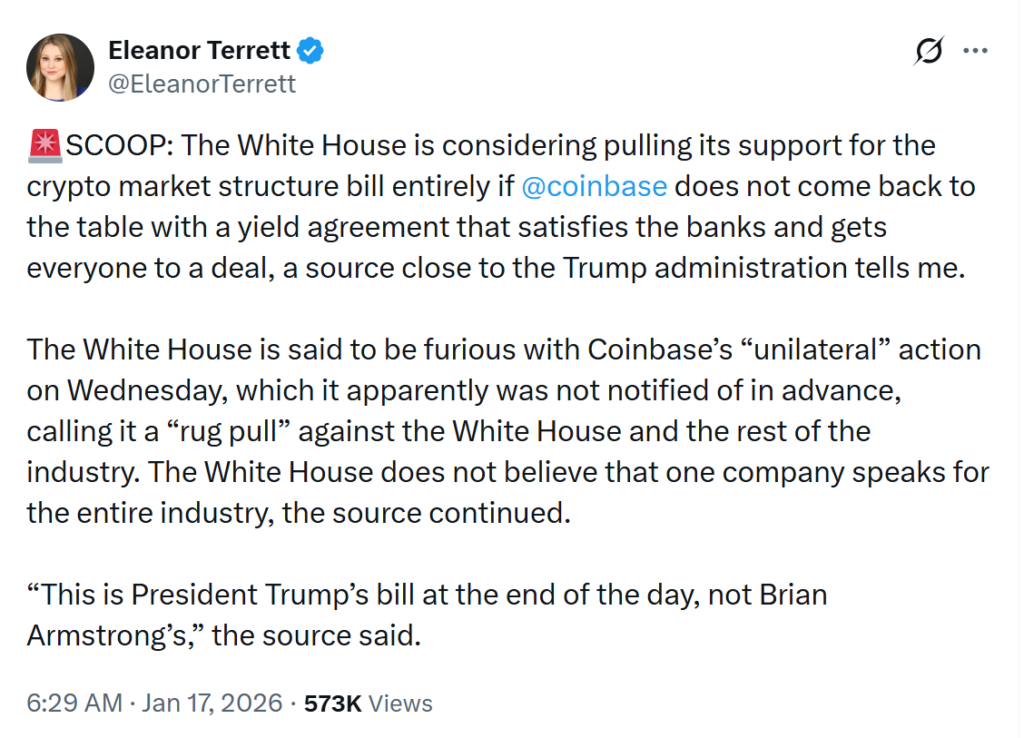

According to Fox Business reporter Eleanor Terrett the White House is furious with Coinbase after the exchange withdrew its support for the Digital Asset Market Clarity Act also known as the CLARITY Act. Terrett cited a source close to the Trump administration who described Coinbase’s action as a surprise move that blindsided officials.

In a post on X Terrett said the decision was viewed inside the administration as a unilateral step taken without prior warning. The source characterised it as a rug pull against the White House and other industry participants who had been negotiating the bill in good faith.

The same source added that the administration may fully abandon the legislation unless Coinbase returns to talks and agrees to compromise particularly on provisions related to stablecoin yields which are seen as sensitive by banking interests.

“This is President Trump’s bill at the end of the day not Brian Armstrong’s” the source said according to Terrett.

Coinbase raises concerns over draft legislation

Coinbase publicly withdrew its backing for the bill earlier this week. Chief executive Brian Armstrong said the exchange could not support the Senate Banking Committee draft in its current form arguing that it would create more problems than it solves.

“We’d rather have no bill than a bad bill. Hopefully we can all get to a better draft” Armstrong said in a public statement.

He outlined several objections including what he described as an effective ban on tokenised equities broad restrictions on decentralised finance and expanded government access to financial data. Armstrong warned that these measures could undermine user privacy and stifle innovation across the crypto ecosystem.

He also criticised the proposed regulatory balance saying the draft would weaken the Commodity Futures Trading Commission while giving greater authority to the Securities and Exchange Commission. The SEC has long been criticised by parts of the crypto industry for relying heavily on enforcement actions rather than providing clear regulatory guidance.

Stablecoins emerge as key flashpoint

Stablecoins have become one of the most contentious elements of the proposed legislation. Armstrong warned that the draft could effectively kill rewards on stablecoins a feature that has helped drive their popularity among users.

Industry participants argue that limiting stablecoin yields is designed to shield traditional banks from competition. At present some stablecoins allow users to earn returns of around five percent which is often higher than interest offered by conventional savings accounts.

Banking groups have warned that such yields could encourage large scale deposit outflows from the traditional banking system potentially threatening financial stability. These concerns have played a significant role in shaping lawmakers’ approach to stablecoin regulation.

The White House source quoted by Terrett suggested that any compromise would need to address these banking concerns particularly around yield generating stablecoin products.

Crypto industry divided over Coinbase stance

Reaction from the crypto community has been mixed. Many users and industry figures backed Coinbase accusing lawmakers and banks of protecting entrenched interests at the expense of innovation.

Nic Carter cofounder of Coin Metrics criticised the banking sector saying that if banks fear competition they should reform their own practices rather than restrict new technologies.

Others however argued that Coinbase had overstepped by attempting to exert excessive influence over legislation that affects the entire industry. Some commentators stressed that Coinbase represents only one exchange and should not have effective veto power over a bill with wide ranging implications.

“Coinbase is not crypto. Coinbase is one exchange in crypto” one user wrote reflecting concerns that the company’s interests may not align perfectly with those of decentralised projects or smaller firms.

Uncertain future for crypto regulation

The standoff leaves the future of the CLARITY Act in doubt. If the White House follows through on its threat to withdraw support the bill could struggle to advance through Congress dealing a blow to efforts to establish a comprehensive regulatory framework for digital assets.

The episode also underscores the fragile relationship between policymakers and the crypto industry. While there is broad agreement on the need for clearer rules disagreements remain over how to balance innovation consumer protection financial stability and competition with traditional banks.

Whether negotiations resume or the bill is ultimately abandoned the outcome is likely to shape the direction of US crypto regulation for years to come.

Leave a Reply