Lawmakers in Wisconsin are taking steps to crack down on cryptocurrency ATM scams by introducing new legislation that would impose strict rules on operators and safeguard consumers. The move follows growing concerns from regulators across the world about the misuse of these machines for fraud and other illegal activities.

Twin Bills Aim to Fast-Track Regulation

On Monday, Senator Kelda Roys and six other Democrats introduced Senate Bill 386 in the Wisconsin Senate. The bill mirrors Assembly Bill 384, filed by Democratic Representative Ryan Spaude on 31 July in the state’s lower house.

Filing identical bills in both chambers is a deliberate strategy. It allows lawmakers in both the Senate and the Assembly to consider the proposals at the same time, increasing the chances of passing the legislation quickly.

The bills target cryptocurrency ATMs also known as kiosks, which allow users to buy or sell crypto for cash. Lawmakers say that, without tighter controls, these machines can be exploited by scammers to steal money from unsuspecting victims.

Key Requirements for Crypto ATM Operators

If passed, the legislation would introduce a number of rules for crypto ATM and kiosk operators in Wisconsin.

- Licensing – Operators would need a money transmitting licence to run their machines legally in the state.

- Customer Information – Operators must collect personal details from users, including their name, date of birth, address, email and a government-issued document such as a driver’s licence or passport.

- Identity Verification – A photograph of the customer would need to be taken and their identity verified for every transaction.

- Daily Limits – Transactions would be capped at a total of $1,000 per customer per day.

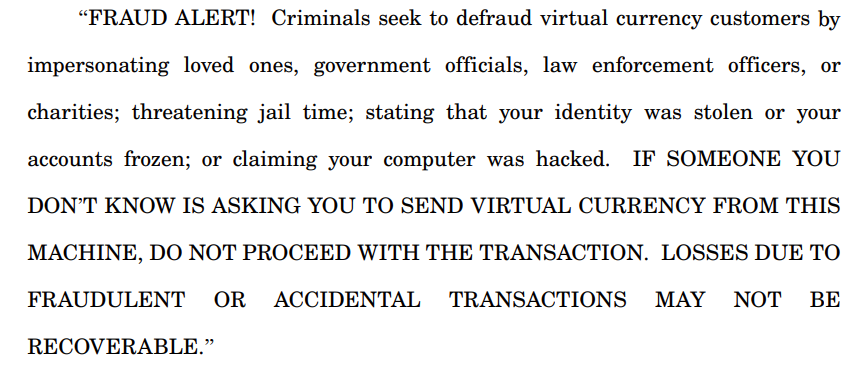

The bills also require warning labels about the risk of fraud to be placed prominently on the front of each machine, ensuring that customers see them before making a transaction.

Fee Caps and Consumer Protection

Crypto ATMs are often criticised for charging high fees compared to online exchanges. To address this, the Wisconsin bills propose limiting operator charges to a flat fee of $5 or 3% of the transaction value, whichever is higher.

The legislation would also introduce strong consumer protections. If a fraudulent transaction occurs such as when money is sent to a scammer, operators would be required to fully reimburse the customer. This applies if law enforcement confirms the fraud within 30 days.

Such measures aim to reduce financial losses for victims and put more responsibility on operators to prevent scams.

Federal and Global Concerns Over Crypto ATM Misuse

The push for regulation in Wisconsin comes shortly after the US Treasury’s Financial Crimes Enforcement Network (FinCEN) issued a warning on 4 August to financial institutions. The agency urged them to report suspicious activity involving crypto ATMs, citing their exploitation in fraud, cybercrime and drug trafficking.

FinCEN Director Andrea Gacki highlighted that criminals have adapted to “exploit innovative technologies” like cryptocurrency kiosks. The agency noted that elderly individuals are especially at risk, with scammers often posing as bank staff, tech support workers or customer service representatives to trick victims into sending money.

Internationally, regulators have taken increasingly tough stances on crypto ATMs. In July, New Zealand banned them nationwide due to concerns over money laundering and criminal financing. In the UK, enforcement agencies seized seven ATMs and arrested two people in southwest London on suspicion of money laundering and operating an unlicensed crypto exchange.

Even in the US, smaller communities have moved preemptively. Grosse Pointe Farms, a suburb outside Detroit, passed local restrictions on crypto ATMs despite not having any within its borders.

A Growing Push for Accountability

The proposed legislation in Wisconsin reflects a broader global trend: governments are tightening oversight of crypto-related services to protect consumers and curb crime. If passed, the new rules could serve as a model for other US states, balancing innovation in financial technology with strong safeguards against exploitation.

While crypto ATMs offer a convenient way to buy or sell digital currencies, the bills highlight that without strict regulation, they can also be a tool for fraudsters. Wisconsin lawmakers appear determined to ensure these machines operate with transparency, accountability and consumer protection at the forefront.

Leave a Reply