Solana Becomes the Latest Chain in WisdomTree’s Multi-Chain Push

WisdomTree has added the Solana blockchain to its growing list of networks supporting its tokenized investment products, marking another step in the firm’s broader multi-chain strategy. The US-based asset manager confirmed that its full range of tokenized funds is now live on Solana, allowing both institutional and retail investors to mint, trade, and hold these assets directly on-chain.

The move brings WisdomTree’s complete tokenized lineup, spanning money market funds, equities, fixed income, alternative assets, and diversified portfolios, to one of the fastest-growing blockchain ecosystems. The company said the expansion is aimed at meeting rising demand for regulated real-world assets in crypto-native environments.

Full Suite of Tokenized Funds Now Live on Solana

With the Solana deployment, all of WisdomTree’s tokenized funds are available on the network, joining existing launches on Ethereum, Arbitrum, Avalanche, Base, and Optimism. The firm positions Solana as a complementary addition rather than a replacement, giving investors more choice in how and where they access tokenized financial products.

According to WisdomTree, Solana’s technical capabilities make it well-suited for on-chain funds that require frequent transactions and efficient settlement. The firm believes this will improve the overall experience for users who want direct wallet-based access to regulated investment products without relying solely on traditional intermediaries.

Focus on Regulated On-Chain Assets

Maredith Hannon, head of business development for digital assets at WisdomTree, said the Solana expansion aligns with the company’s long-term focus on regulated real-world assets. She noted that the goal is to combine blockchain-based distribution with compliance standards expected by large financial institutions.

Hannon also pointed to Solana’s transaction speed as a key factor behind the decision. The network’s ability to process high volumes of transactions at low cost allows WisdomTree to serve crypto-native users while maintaining safeguards around asset issuance and management.

Solana’s Growing Role in Tokenized Real-World Assets

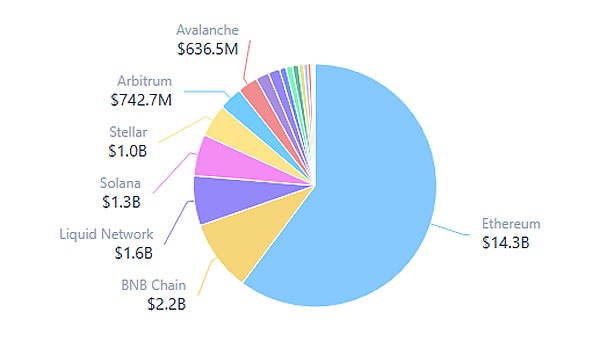

Solana has emerged as a significant player in the tokenized real-world asset space. Data from RWA.xyz shows the network hosts around 1.3 billion dollars in distributed tokenized asset value, giving it roughly a 5.6 percent share of the market. This places Solana fourth among blockchains supporting tokenized RWAs.

Despite this growth, Solana remains well behind Ethereum, which continues to dominate the sector with more than 60 percent market share. Even so, Solana’s performance-focused design has attracted projects looking to scale on-chain distribution without sacrificing speed or usability.

Distributed assets rely on blockchains as a delivery layer, allowing investors to subscribe to, hold, and manage financial products through self-custody wallets or regulated custodians. This model is increasingly seen as a bridge between traditional finance and decentralized infrastructure.

Access Through WisdomTree Platforms and USDC On-Ramps

Investors will be able to access WisdomTree’s tokenized funds on Solana through the company’s WisdomTree Connect and WisdomTree Prime platforms. In addition, users can directly on-ramp USDC from Solana into these applications, simplifying the process of moving capital on-chain.

Nick Ducoff, head of institutional growth at the Solana Foundation, said WisdomTree’s expansion reflects broader demand for scalable access to tokenized real-world assets. He added that Solana’s infrastructure is designed to support such demand as more traditional financial players explore blockchain-based distribution.

As asset managers continue to test multi-chain approaches, WisdomTree’s Solana launch highlights how established firms are adapting their products to meet investors where they already operate on-chain.

Leave a Reply