XRP has entered a critical phase as the supply of tokens held on cryptocurrency exchanges has dropped to levels last seen eight years ago. This sharp decline in readily available XRP is fuelling discussion across the market about a possible supply driven rally in 2026. With selling pressure easing and price holding above a historically strong demand zone traders and long term holders are watching closely to see whether this tightening liquidity can translate into sustained upside over the next cycle.

Recent data indicates that investors are increasingly moving XRP off exchanges signalling a preference to hold rather than sell. This behaviour often precedes periods of price stability or appreciation particularly when combined with strong technical support levels. As XRP trades near 1.87 dollars and remains above a crucial price floor the coming months could define its trajectory into 2026.

Exchange Balances Slide to Levels Last Seen in 2018

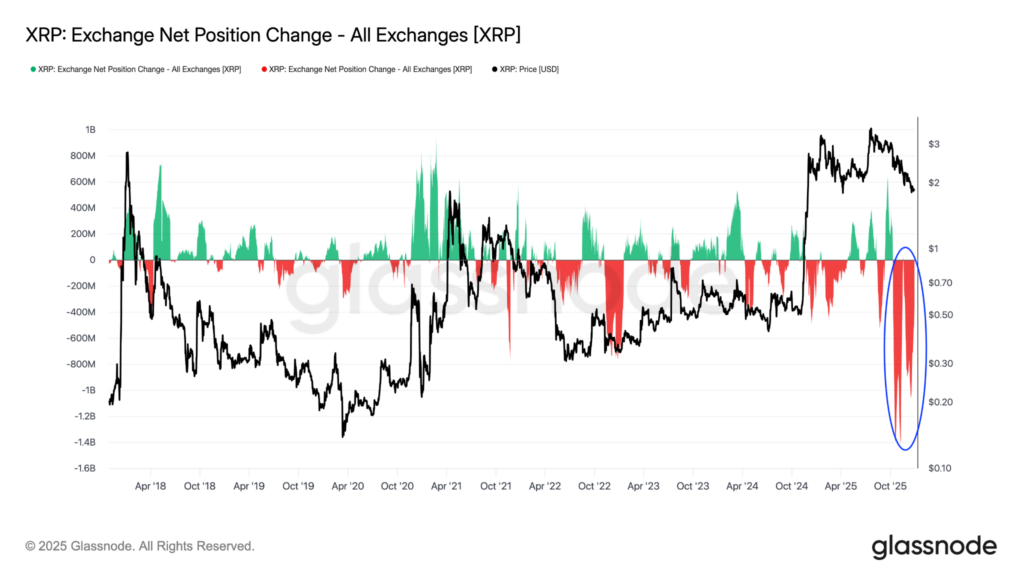

On chain data from Glassnode reveals a steep fall in XRP balances held on centralised exchanges over the past two months. Exchange supply has dropped from around 3.76 billion tokens in early October to roughly 1.6 billion tokens by late December. This represents a reduction of more than 2.1 billion XRP in just sixty days placing exchange balances at their lowest point since August 2018.

A falling exchange balance is widely interpreted as a bullish signal within crypto markets. When holders withdraw assets from exchanges they typically intend to store them in private wallets or long term custody solutions rather than sell them in the near term. This reduces the immediately available supply that can be sold into the market which in turn can limit downside pressure on price.

Market commentators have highlighted the speed and scale of this decline as particularly noteworthy. Trader and analyst Levi Rietveld described the situation as a clear tightening of supply noting that only about 1.5 billion XRP now remains on exchanges. According to his assessment such conditions historically favour price appreciation especially if demand remains steady or increases.

The latest drop did not occur gradually but accelerated rapidly in mid October. On October 19 the net position change across exchanges showed an outflow of approximately 1.4 billion XRP in a single day marking the largest exchange outflow event in the asset’s history. This unprecedented movement suggests coordinated accumulation rather than retail driven withdrawals.

Institutional Accumulation and the Role of Investment Products

A growing narrative within the XRP community is that institutional players are increasingly active in the market. Large scale withdrawals from exchanges are often associated with whales or professional investors moving assets into cold storage custodial solutions or structured investment products.

Some analysts believe that exchange traded products and similar vehicles are playing a role in absorbing XRP liquidity. Pseudonymous trader Skipper argued that these products are effectively draining XRP from the open market and tightening liquidity conditions. In his view this shift is helping reposition XRP as a more institutionally oriented digital asset heading into 2026.

The logic behind this argument is straightforward. As institutional interest grows assets tend to migrate away from high turnover trading environments and into long term holdings. This structural change can alter price dynamics by reducing volatility on the downside while amplifying moves when new demand enters the market.

Skipper suggested that XRP is entering a more structural phase of price discovery. In such a phase prices are less driven by short term speculation and more influenced by long term positioning and macro level adoption trends. If this thesis holds XRP could experience a different type of cycle compared with previous years characterised by slower accumulation followed by sharper breakouts once supply constraints become apparent.

However it is worth noting that institutional involvement alone does not guarantee higher prices. Broader market sentiment regulatory developments and macroeconomic conditions will also play significant roles. Even so the scale of recent outflows supports the idea that a meaningful portion of XRP supply is being locked away for longer horizons.

XRP Defends a Crucial Demand Zone Above 1.78 Dollars

While supply dynamics tell one side of the story price action provides another critical perspective. XRP has managed to hold above a key demand zone between 1.60 dollars and 1.84 dollars throughout much of 2025. This area has repeatedly acted as a floor during market pullbacks suggesting strong buyer interest.

At the centre of this zone lies the 1.78 dollar level which Glassnode data identifies as the most significant support price for current holders. Using the UTXO realised price distribution metric analysts can see where existing XRP supply was last transacted. Approximately 1.87 billion XRP were acquired around the 1.78 dollar mark making it a psychologically and technically important level.

If price remains above this zone holders who bought at these levels are less likely to sell at a loss reinforcing stability. Conversely a decisive break below 1.78 dollars could weaken confidence significantly as there is limited historical support beneath this range. Analysts warn that losing this level would severely reduce the likelihood of a meaningful recovery in 2026.

So far buyers have successfully defended this area during recent drawdowns. Each test of the zone has attracted demand suggesting that market participants view current prices as attractive relative to perceived long term value. This behaviour aligns with the observed reduction in exchange balances strengthening the case for accumulation rather than distribution.

Technical Patterns Point to Potential Upside Scenarios

From a technical analysis perspective some traders see the possibility of a bullish reversal forming on higher time frames. Analysts including VipRoseTr have pointed to a potential triple bottom pattern developing on the weekly chart. Such formations often indicate exhaustion of selling pressure and the beginning of a trend reversal.

According to this view a sustained rebound from the current demand zone could trigger a breakout from a long standing downtrend channel. If confirmed this move could open the door to a rally towards the 3.79 dollar region which would represent a significant gain from current levels.

However confirmation remains key. Technical patterns are probabilistic rather than predictive and require follow through in volume and momentum. A failure to hold support or a lack of buying interest on rebounds could invalidate the bullish setup.

Other analysts remain more cautious suggesting that XRP may continue to trade within a broad range into 2026. They argue that while supply conditions are improving a strong uptrend will likely require additional catalysts. These could include clearer regulatory outcomes expanded institutional adoption or renewed strength across the wider crypto market.

This balanced outlook reflects the complex interplay of factors shaping XRP’s future. Supply tightening alone can support prices but sustained rallies usually depend on both demand growth and positive sentiment.

Outlook for 2026 Depends on Supply Demand Balance

As 2025 draws to a close XRP finds itself at a crossroads. On one hand the sharp decline in exchange supply points to reduced selling pressure and growing conviction among holders. On the other hand price remains constrained within a well defined range awaiting a decisive catalyst.

If current trends persist into 2026 the market could experience a classic supply shock scenario. With fewer tokens available on exchanges even moderate increases in demand could have an outsized impact on price. This dynamic has played out before in crypto markets particularly during periods of institutional accumulation.

That said risks remain. Macro uncertainty regulatory shifts and broader market cycles could all influence outcomes. XRP’s ability to maintain support above 1.78 dollars will be a key metric to watch in the coming months. Holding this level would reinforce the bullish thesis while a breakdown could delay recovery plans.

For now XRP appears to be transitioning from a period of distribution to one of accumulation. Whether this transition ultimately results in a sustained rally in 2026 will depend on how supply dynamics align with future demand drivers. Investors and traders alike will be monitoring exchange balances price behaviour and on chain data for clues about the next major move.

Leave a Reply