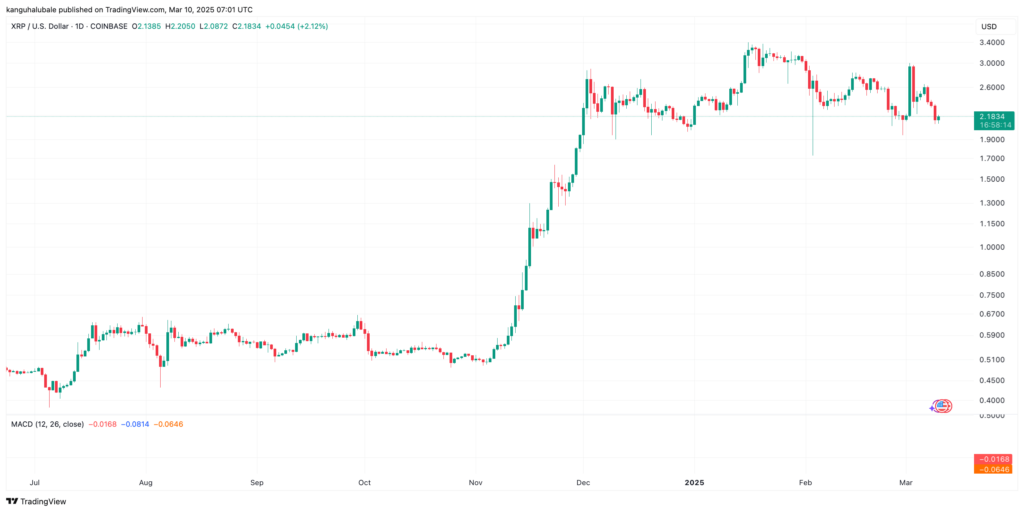

XRP’s price recovery from its recent low of $1.94 has provided some relief to investors, but the cryptocurrency remains under pressure as it struggles to break key resistance levels. Despite its recent rally, XRP risks further declines unless bulls manage to hold the critical $2.00 support level.

XRP’s Key Levels in Focus

XRP has been in a corrective phase since March 3, following its drop from $3.00. The relative strength index (RSI) has fallen sharply and now sits at 42, suggesting that market conditions still favour the downside.

The psychological support at $2.00 remains a crucial level for XRP’s price action. This level has held firm since December 1, and a breakdown could trigger further losses. If XRP fails to maintain support above this threshold, the price could extend its decline to the recent range low at $1.76, recorded on February 3. The next significant support sits at $1.61, aligning with the 200-day simple moving average (SMA).

Resistance at $3.00 Blocks Further Gains

XRP’s recent price movements have been shaped by strong resistance at the $3.00 mark. A 66% rally between February 3 and March 2 was halted by significant selling pressure at this level. This has resulted in a pullback, with XRP now consolidating near the upper boundary of a weekly bull flag pattern at $2.16.

For a bullish breakout, XRP needs to convert resistance in the $2.53–$2.62 range into support. These levels coincide with the 100-day and 50-day SMAs, making them crucial for a potential rebound. A sustained close above the 50-day SMA could set the stage for a return to $3.00 and possibly a seven-year high above $3.40.

Market Indicators Point to Further Decline

While some analysts remain optimistic about XRP’s long-term prospects, technical indicators suggest a further pullback may be on the horizon. The moving average convergence divergence (MACD) has formed a bearish cross, indicating a potential continuation of the downtrend. If XRP closes below the weekly support level of $2.16, it could re-enter the bull flag formation and consolidate for an extended period.

Adding to concerns, the XRP liquidation heatmap shows a cluster of bids around the $2.00 mark, indicating that many traders are placing orders at this level. A failure to maintain this support could lead to an accelerated decline towards the 50-week exponential moving average (EMA) at $1.46.

External Factors Impacting XRP’s Trajectory

Beyond technical indicators, broader market factors may also influence XRP’s price action. As reported, the US government’s decision to sell altcoins from its newly established Digital Asset Stockpile could weigh on XRP’s upward momentum. The fading hype around this strategic reserve may further limit the cryptocurrency’s ability to sustain a rally.

For now, all eyes remain on the $2.00 support level. If XRP bulls manage to defend this key threshold, the altcoin could stabilise and attempt another breakout. However, a breach below this level could open the door to further losses, with downside targets at $1.76 and $1.61.

Leave a Reply