On-chain data and chart patterns suggest a possible 25% price drop for XRP

XRP has surged over 385% since late 2024, recently trading at $2.30. However, fresh network analysis and technical indicators suggest that this rally may have reached its peak. Both on-chain data and price patterns are signalling a heightened risk of a significant correction, possibly dragging the price down by 25% toward key support levels.

Over 70% of Realised Cap Formed Near Recent Highs

According to Glassnode data, more than 70% of XRP’s realised market capitalisation—based on the price at which each token last moved—was accumulated between late 2024 and early 2025. This signals that a large portion of the current investor base bought in at or near the recent highs.

Particularly notable is the growth in the 3-to-6-month coin age group, which has risen sharply since November 2024 and accelerated after XRP peaked around $3.40 in January 2025. Historically, such “top-heavy” market structures, dominated by short-term holders, are vulnerable during corrections. Newer investors are often more reactive to price volatility, increasing the likelihood of abrupt sell-offs.

This pattern mirrors previous market cycles. In late 2017, XRP’s realised cap surged as new investors entered near the peak of $3.55, followed by a 95% crash. A similar spike in short-term holdings occurred in 2021, preceding a near 80% decline. These parallels raise the possibility that the January 2025 peak could mark another local top for XRP.

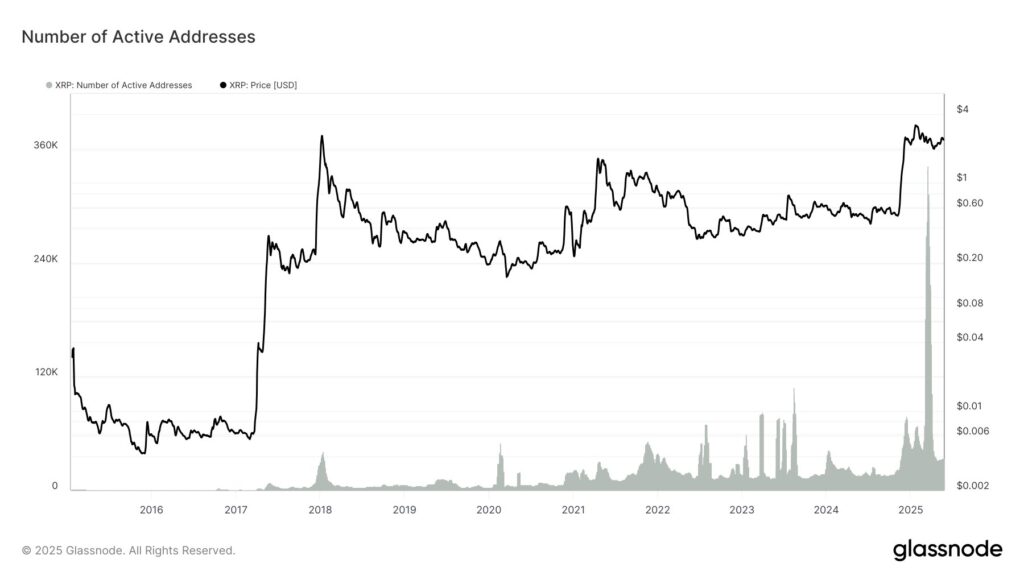

Network Activity Plummets Over 90%

Another red flag is the dramatic drop in XRP’s network activity. Active addresses hit record highs in March 2025 during the rally but have since plunged by more than 90%. This steep decline suggests a significant decrease in transactional demand and utility.

Falling active address counts, especially during price consolidation or rallies, have historically preceded major market corrections. In both the 2017 and 2021 peaks, similar patterns were observed—a surge in price not matched by sustained on-chain engagement, indicating growing investor apathy or speculative holding rather than real-world usage.

Though not a guaranteed predictor, the current divergence between price action and network activity could imply that XRP is becoming more of a hold-only asset than one actively used for transactions. This weakens the fundamentals underpinning its valuation.

Falling Wedge Pattern Hints at Correction

From a technical standpoint, XRP is forming a falling wedge pattern on its weekly chart—a typically bullish formation, but one that often precedes a final dip before a breakout. As of 26 May, XRP failed to breach the upper boundary of this wedge, instead showing signs of entering a short-term correction.

This price rejection points towards potential downward movement, especially if the pattern plays out as expected. A full retracement toward the lower trendline of the wedge could bring XRP down to around $1.76. This level also coincides with the 50-week exponential moving average (EMA), making it a critical support zone.

Such a move would mark a 25% decline from current levels and align with previous post-peak corrections seen in prior cycles.

Past Cycles Echo Present Risks

Market history seems to be repeating itself. In 2017 and 2021, similar patterns of top-heavy realised caps and falling user engagement appeared just before major XRP price collapses. If the current metrics are any indication, the cryptocurrency may be poised for another round of profit-taking and a subsequent drop.

While long-term fundamentals for XRP remain debated within the community, the near-term indicators suggest caution. Investors entering at current levels could be buying into a topping market, raising the risk of exposure during a volatile correction phase.

What Lies Ahead?

The coming weeks may prove pivotal for XRP. If price continues to consolidate and fails to reclaim upper resistance zones, technical pressure may push the token toward the $1.76 support area. The declining user activity only strengthens the bearish outlook, as real-world usage is often a key pillar of sustained value in the crypto space.

As always, market conditions can shift quickly. But with over 70% of recent capital inflows now sitting in precarious positions, the data points toward a cooling phase for XRP. Investors may need to brace for a turbulent period as the market recalibrates following months of parabolic gains.

Leave a Reply