XRP appears to have stabilized after a prolonged decline, with several technical, onchain and institutional indicators suggesting that the drop to $1.12 on Feb. 6 may mark a meaningful bottom. Since then, the token has rebounded sharply, climbing nearly 50 percent to a local high near $1.67 before settling around $1.43. While XRP remains well below its multi-year peak of $3.66, the behavior of traders, long term holders and institutions is beginning to paint a more constructive picture.

A mix of falling exchange balances, extreme derivatives positioning, renewed spot market demand and steady ETF inflows is strengthening the case for a recovery phase. Together, these data points suggest that selling pressure may be fading and that buyers are gradually regaining control.

Exchange balances slide to multi-year lows

One of the strongest bullish signals is the continued decline in XRP held on centralized exchanges. Onchain data from Glassnode shows that the total XRP balance on exchanges has dropped to about 12.9 billion tokens, a level last seen in May 2021. This steady outflow has been underway for nearly two years.

When fewer tokens are held on exchanges, it often indicates that investors are moving assets into self-custody rather than preparing to sell. This behavior typically reflects long term conviction and reduces the immediate supply available to the market, easing downward price pressure.

Supporting this trend, data from CryptoQuant highlights a sharp decline in XRP reserves on Binance, now hovering around 2.57 billion XRP. Both the 50 day and 100 day simple moving averages of exchange reserves continue to slope lower, reinforcing the idea that distribution is slowing.

CryptoQuant contributor PelinayPA noted that reserves are falling even as price trades near recent lows, a structure that can increase the odds of a short squeeze if demand picks up unexpectedly.

Funding rates reflect crowded bearish bets

Derivatives data adds another layer to the bottoming narrative. As XRP slid to $1.12 earlier this month, perpetual futures funding rates on Binance dropped to negative 0.028 percent, their lowest reading since April 2025. Negative funding rates indicate that short sellers are paying a premium to maintain their positions, often a sign of crowded bearish trades.

Historically, such extreme negative funding conditions have tended to coincide with market bottoms. When too many traders lean in the same direction, even a modest price bounce can force short positions to unwind, accelerating upside moves.

A similar setup in April 2025 preceded a rally of roughly 65 percent, when XRP climbed from $1.60 to $2.65 as shorts rushed to cover. Comparable dynamics were also observed during late 2024, when heavily skewed funding rates led to sharp recoveries.

At the same time, futures open interest has fallen significantly. According to CoinGlass, XRP open interest now sits near $2.53 billion, down about 55 percent from early January highs of $4.55 billion. This decline suggests that leveraged traders are stepping back rather than doubling down, a shift that often accompanies the exhaustion of a bearish trend.

Spot market data shows buyers stepping in

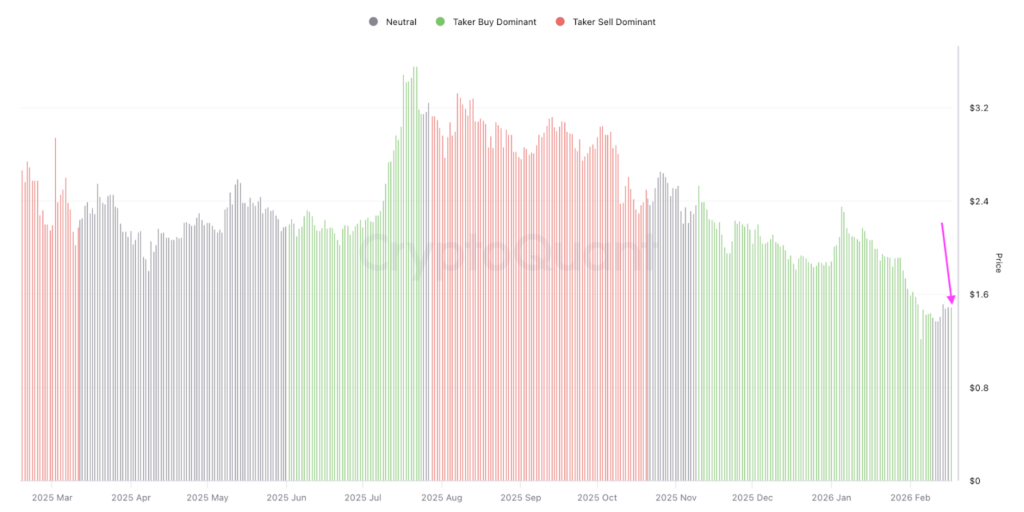

Beyond derivatives, spot market behavior is beginning to turn positive. The 90 day spot taker cumulative volume delta, or CVD, which tracks the balance between aggressive buyers and sellers, has recently flipped into positive territory.

For much of the recent downtrend, CVD hovered near neutral, reflecting hesitation and balance between buying and selling pressure. This week, however, taker buy volume has started to dominate, indicating that buyers are once again willing to absorb available supply at current levels.

A sustained positive CVD typically suggests accumulation, as market participants actively buy rather than waiting with passive orders. If this trend holds, it could form the foundation for a more durable advance, similar to patterns seen in previous XRP recoveries after extended drawdowns.

XRP ETFs continue to draw institutional capital

Institutional demand has also remained resilient despite the recent price weakness. US based spot XRP exchange traded funds have recorded inflows on 53 of the last 59 trading days since their launch in November 2025, according to data from SoSoValue.

These products added $4.5 million in fresh capital on Friday alone, pushing cumulative inflows to approximately $1.23 billion. Total assets under management across spot XRP ETFs now exceed $1.01 billion, highlighting consistent interest from professional investors.

The trend extends beyond the US market. While global crypto investment products experienced a fourth consecutive week of outflows totaling $173 million, XRP focused exchange traded products stood out. They attracted $33.4 million in net inflows during the week ending Feb. 13, making XRP the strongest performer among major digital asset ETPs for that period.

This divergence suggests that institutions continue to view XRP as a strategic allocation, even as broader market sentiment remains cautious.

Are bulls ready to take control

Taken together, the data points suggest that the sell-off to $1.12 may have flushed out weak hands and excessive leverage. Declining exchange balances point to reduced selling intent, extreme funding rates hint at a crowded short trade, spot volume metrics show renewed buyer activity and ETF inflows confirm ongoing institutional interest.

While no single indicator guarantees a sustained reversal, the alignment of these factors strengthens the argument that XRP is building a base for recovery. For now, the market appears to be shifting from fear-driven liquidation toward cautious accumulation. Whether this develops into a full trend reversal will depend on follow-through from buyers and broader market conditions, but the evidence increasingly suggests that the worst of the recent downturn may be behind.

Leave a Reply