Ripple’s native token, XRP, has soared 42% in the past week, hitting a new all-time high of $3.40. On Thursday alone, XRP’s 24-hour trading volume surpassed that of Ethereum (ETH), signaling robust market interest. As of Friday, the altcoin traded at $3.2385, with analysts predicting further gains as it enters a price discovery phase.

President-elect Donald Trump’s inauguration, optimism surrounding pro-crypto policies, and potential regulatory clarity are driving bullish sentiment. These factors could sustain XRP’s rally alongside Bitcoin, which rebounded to $104,000 after briefly dipping below $90,000.

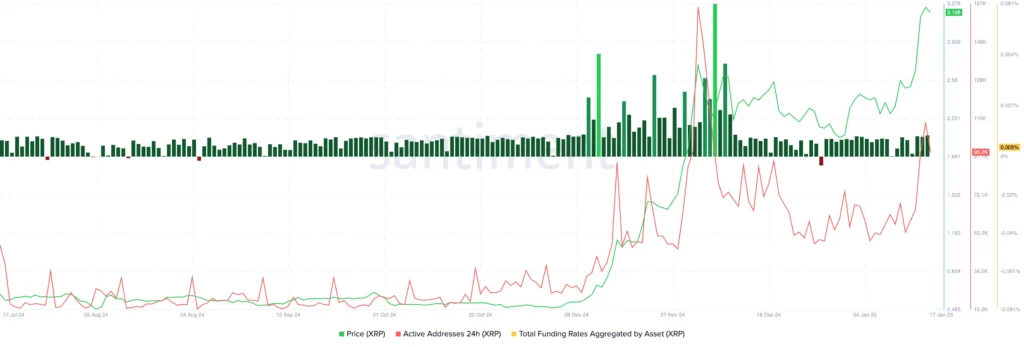

On-Chain Metrics Signal Strength

XRP’s on-chain indicators support its continued upward trajectory. Metrics such as funding rates, active addresses, and supply distribution highlight strong investor participation:

- Funding Rate: Positive throughout January, indicating bullish market sentiment.

- Active Addresses: Spiked significantly on January 16, reflecting heightened transaction activity.

- Supply Distribution: Wallets holding 10,000 to 100,000, 1 million to 10 million, and 100 million+ XRP have accumulated tokens, showcasing growing confidence among both retail and institutional investors.

These indicators collectively reinforce the case for sustained price growth in the coming weeks.

Ripple Lawsuit and Market Dynamics

Despite ongoing legal challenges from the U.S. Securities and Exchange Commission (SEC), XRP’s rally remains undeterred. The SEC recently appealed a July 2023 ruling that classified secondary XRP sales as non-securities, seeking to reverse the decision.

Market optimism also stems from RippleNet’s growing institutional adoption and developments in the RLUSD stablecoin. According to Ryan Lee, Chief Analyst at Bitget Research:

“XRP’s surge can be attributed to favorable outcomes in Ripple’s SEC lawsuit and a more crypto-friendly political climate in the U.S. If regulatory uncertainties are resolved, institutional investors could further solidify XRP’s position in the market.”

Technical Analysis and Price Forecast

XRP currently hovers near its all-time high, with analysts projecting a potential 22% rally to the 141.4% Fibonacci retracement level at $4.15. Key technical indicators support the bullish outlook:

- MACD: Consecutive green histogram bars indicate upward momentum.

- RSI: At 83, suggesting the token is overbought, cautioning traders of potential corrections.

If a pullback occurs, XRP could find support at $2.6977, the 50% Fibonacci retracement level.

Expert Insights on XRP’s Future

James Toledano, COO of Unity Wallet, sees the altcoin’s breakout as a sign of renewed investor optimism, driven by regulatory clarity and the potential approval of an XRP ETF. He notes:

“If an XRP ETF is approved, it could unlock significant capital inflow, pushing the token to new heights in 2025.”

However, Toledano warns of inherent volatility in altcoins compared to Bitcoin, emphasizing the unpredictable nature of market cycles.

Leave a Reply