Despite a notable selloff in Korean markets, XRP long-term holders continue to exhibit strong conviction, clinging to optimism amid bearish pressures. On-chain data highlights key dynamics, from whale accumulation to technical patterns, that could shape XRP’s future price trajectory.

Long-Term Holders in the Denial Phase

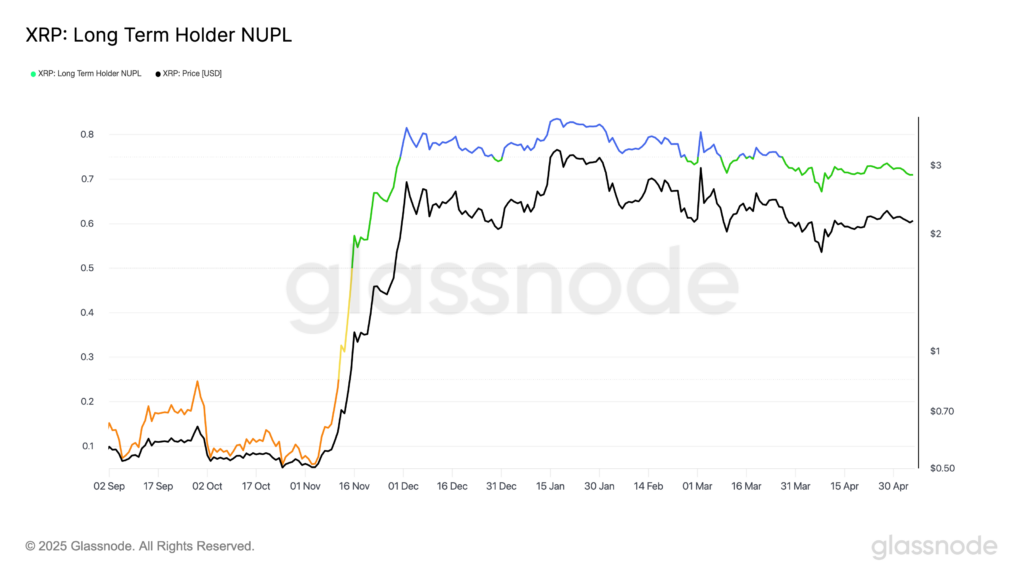

Glassnode‘s Net Unrealized Profit/Loss (NUPL) data indicates that XRP investors have entered the “denial” phase of the market cycle. This phase often follows euphoria, as investors hope for a recovery despite a broader price correction.

Since mid-December, XRP’s NUPL has ranged between 0.55 and 0.65, reflecting stubborn optimism. Even as XRP’s price dipped from above $3 to $2, long-term holders have resisted selling. This steadfastness suggests confidence in a future rebound, underpinned by broader market narratives.

ETF Anticipation Fuels Optimism

Investor sentiment remains buoyant partly due to the anticipated approval of a spot XRP exchange-traded fund (ETF). Major firms, including Grayscale, WisdomTree, and Bitwise, have filed for these ETFs, with Grayscale’s application facing a critical decision by May 22, 2025.

A successful ETF launch could unlock institutional inflows and bolster long-term price prospects, adding to the bullish narrative around XRP.

Whale Activity Signals Strategic Accumulation

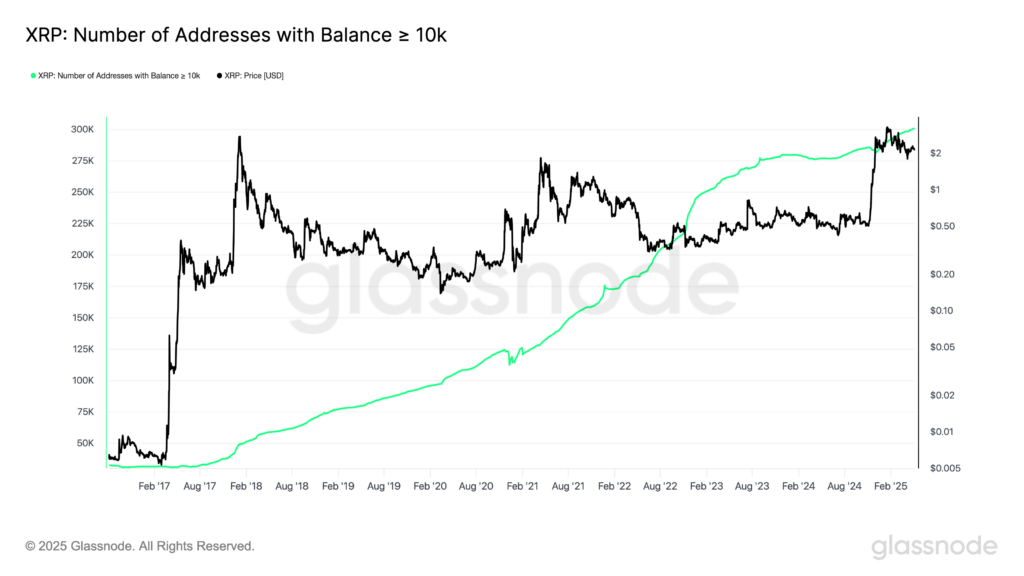

Large XRP holders, or “whales,” have steadily increased their positions, providing a bullish counterpoint to recent price declines. Glassnode reports a record number of addresses holding at least 10,000 XRP, surpassing 290,000.

This accumulation trend suggests that high-net-worth investors view current price levels as a buying opportunity rather than a reason to exit. Historically, rising whale participation during corrections has often signaled strategic positioning for future gains.

Falling Wedge: Breakout or Breakdown?

From a technical standpoint, XRP’s daily chart reveals a falling wedge pattern—a classic bullish setup. This formation indicates weakening selling pressure, with potential breakout levels near $2.20. Upside targets include $3.00–$3.40, with a projected peak of $3.68 based on the wedge’s height.

However, a failure to break above resistance could invalidate this bullish scenario, risking deeper corrections to the $1.80–$1.70 range. Traders should monitor key levels closely to assess the validity of this pattern.

Korean Markets Turn Bearish

One significant headwind comes from the Korean market. Data from Upbit reveals that over 220 million XRP—worth more than $500 million—has been sold since April 11.

This substantial selling pressure underscores a shift in sentiment among Korean traders, contrasting the optimism seen in Western markets. If bearish momentum persists, it could challenge the resolve of XRP’s long-term holders and exacerbate downside risks.

Leave a Reply