XRP has climbed past the $3 mark, sparking renewed optimism among traders and analysts who believe the cryptocurrency could be on course for a rally toward $4.50. Strengthening institutional inflows, rising derivatives activity, and positive technical signals are reinforcing expectations of further upside momentum.

Institutional Inflows Boost Investor Confidence

Institutional demand for XRP remains steady, with investment products drawing notable inflows. According to CoinShares, XRP exchange-traded products (ETPs) attracted $14.7 million in the week ending 5 September. Cumulative inflows for the year now stand at $1.4 billion.

By contrast, Ether recorded outflows of $912 million over the same period, suggesting that investors are rotating capital into alternative assets, including XRP. Other top cryptocurrencies also drew inflows, with Bitcoin gaining $524 million, Solana $16.1 million, and Sui $600,000.

Analysts note that speculation surrounding a potential XRP exchange-traded fund (ETF) approval in the United States is fuelling optimism. The prospect of regulated access to XRP for institutional players has been a major driver of recent price action.

Derivatives Market Signals Growing Momentum

XRP’s derivatives activity also highlights renewed interest. Open interest has risen by 11 per cent in the past week to $8.3 billion, up from $7.4 billion on 4 September, according to CoinGlass. Within the last 24 hours alone, open interest has increased by 4 per cent.

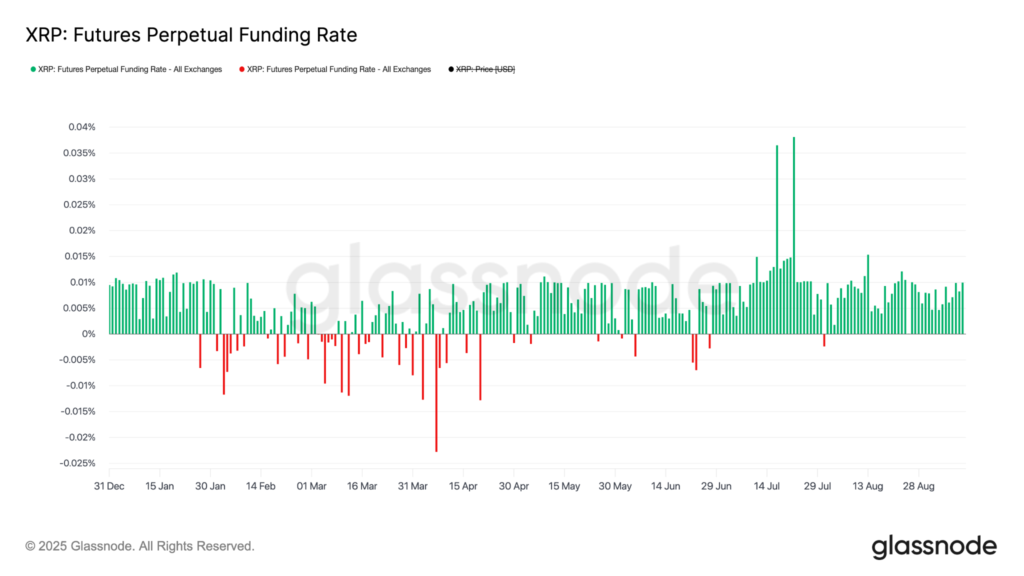

Funding rates in perpetual futures contracts have remained positive since 1 August and have been trending higher over the past 10 days. This shows that more traders are betting on price gains rather than declines. Analysts argue that this combination of higher open interest and positive funding rates suggests building momentum for a sustained rebound above $3.

Technical Breakout Above $3

On the charts, XRP has broken out of a multi-month symmetrical triangle pattern, closing above the key resistance level of $2.95 earlier this week. This marks the first decisive move beyond the consolidation range that has held since mid-July.

Market analyst CasiTrades noted that confirmation of the breakout is taking shape with the $3 test now in play. Key resistance levels on the upside are seen at $3.08 and $3.27, while Fibonacci extensions from the longer consolidation point toward $4.50 as a potential target.

Momentum indicators also support the bullish outlook. The relative strength index (RSI) has climbed from 36 to 54 over the past week, suggesting strengthening buying pressure.

Short-Term Levels and Longer-Term Outlook

Fellow analyst Egrag Crypto highlighted that an ascending triangle on the four-hour chart points to $3.12 if support holds at $2.97. Beyond that, a decisive close above $3 could pave the way for gains to $3.15 and later $3.40.

Despite the growing optimism, traders caution that bulls must clear resistance at $3.66, the multi-year high, before aiming for the $4.50 target. Some analysts are even more ambitious, projecting XRP could reach $20 during this market cycle based on Elliott Wave analysis.

For now, XRP’s combination of institutional inflows, strong derivatives data, and technical breakout signals suggests that the cryptocurrency may be well-positioned for further gains, with $4.50 emerging as the next logical milestone.

Leave a Reply