The United States Securities and Exchange Commission (SEC) has formally commenced its review of the WisdomTree XRP Trust, a proposed spot exchange-traded fund (ETF) that would provide U.S. investors with direct exposure to XRP through traditional brokerage accounts. This development represents a significant step forward for both XRP and the broader digital asset market, marking the first formal SEC evaluation of a U.S.-based spot XRP ETF.

If approved, the ETF would offer investors a regulated and familiar vehicle to gain exposure to XRP, bypassing the complexities of digital wallets and private key management. The application, submitted by Cboe BZX Exchange, could potentially pave the way for similar crypto ETFs in the future.

SEC Initiates Review Process

The SEC published its official notice under Release No. 34-103124, signalling the beginning of a comprehensive review of the WisdomTree XRP Trust. The Commission has up to 240 days to either approve or deny the application.

In line with the standard ETF approval process, the SEC is now inviting public comments on the filing. The agency will assess whether the proposed product includes adequate investor protections and safeguards against market manipulation, which have long been concerns surrounding crypto-based investment vehicles.

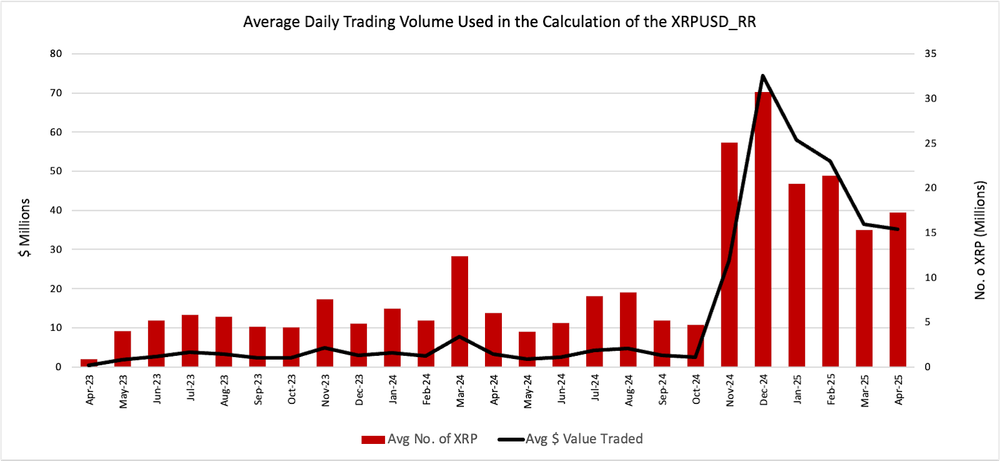

The ETF is designed to track XRP’s market price via the CME CF Ripple-Dollar Reference Rate, offering a regulated alternative to buying XRP on crypto exchanges. This could open the asset class to a broader range of institutional and retail investors who are otherwise reluctant to engage with the unregulated crypto market directly.

Ripple Reiterates XRP’s Non-Security Status

In tandem with the ETF application, Ripple’s Chief Legal Officer, Stuart Alderoty, submitted a letter to the SEC’s Crypto Task Force. The letter was a direct response to SEC Commissioner Hester Peirce’s recent “New Paradigm” speech, which questioned when a digital asset ceases to be tied to an investment contract.

Alderoty argued that XRP should not be considered a security in itself, a stance Ripple has consistently maintained throughout its legal battles with the SEC. He emphasised the need for clear regulatory definitions, stating:

“Rules must be clear not just for issuers, but for all market participants who could be unwittingly classified as securities exchanges, brokers, dealers, or issuers.”

He also criticised the SEC’s reliance on ambiguous terms such as “fully functional” or “decentralised”, asserting that such vagueness leads to regulatory confusion rather than clarity.

A Milestone for XRP and the Broader Crypto Market

The approval of a spot XRP ETF in the U.S. would be a historic milestone, not only for XRP but for the broader cryptocurrency market. While Bitcoin and Ethereum have seen increased institutional acceptance through futures-based and spot ETFs, other digital assets like XRP have remained on the sidelines.

This potential approval could set a precedent for other altcoin-based ETFs, especially if the SEC is satisfied with the market surveillance and investor protection mechanisms outlined in the filing. Such developments could lead to broader crypto adoption within the traditional financial ecosystem.

Market Implications and Next Steps

Over the next eight months, the SEC will closely scrutinise the WisdomTree XRP Trust proposal. Market participants, legal experts, and crypto advocates are expected to submit their views during the public comment period, offering feedback that could influence the final decision.

Should the ETF gain approval, it may trigger a surge in XRP investment demand and renew momentum for altcoin ETFs. However, the outcome will depend heavily on how effectively the proposal addresses the SEC’s concerns around manipulation, custody, and investor risk.

As the SEC’s review unfolds, all eyes will be on whether XRP can cross the regulatory threshold and join Bitcoin and Ethereum in achieving mainstream ETF recognition.

Leave a Reply