XRP has failed to reclaim the $3 level after tumbling more than 20% from its July peak, leaving traders debating whether the cryptocurrency can still stage a recovery. While the recent dip has unsettled some investors, several market analysts remain confident that a breakout could soon follow if key support levels hold.

XRP Slides Below $3 Psychological Barrier

XRP is currently trading at around $2.96, extending its decline after dropping from July’s high near $3.66. The token has shed over 20% in that period, including a 4% fall in the last 24 hours that pushed it below the psychological $3 mark.

The crucial $2.95 level is now acting as the immediate line of defence. Many traders view this as a pivotal point that will determine whether XRP can mount a fresh rally or slip into a deeper correction.

Potential Recovery Targets Around $4.40

Technical analysts believe XRP has scope to rebound provided it can maintain support near $2.95. Elliott Wave specialist Avi Harkishun argues that the zone previously acted as resistance in 2021 before turning into support earlier this year, making it a strong base for a potential bounce.

According to Harkishun, a recovery could lift XRP toward the $4.00 to $4.40 range, aligning with the 1.618 Fibonacci retracement level measured between the $3.38 swing high and the $1.61 swing low.

Other chart-watchers, including the pseudonymous analyst ThePenguinXBT, have labelled these levels as an attractive long opportunity. A prevailing bull pennant pattern on XRP’s chart also supports the case for an eventual breakout, with an upside target around $4.62.

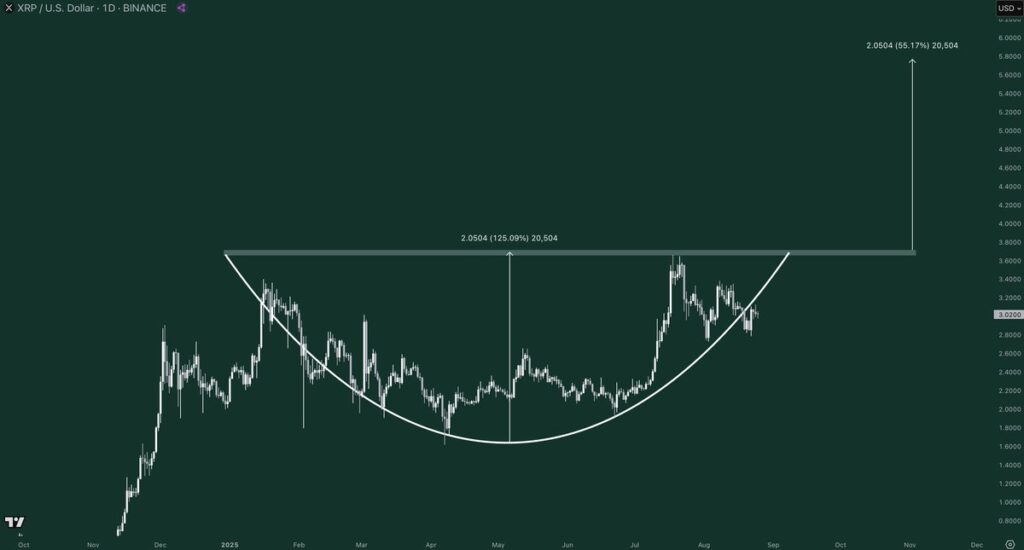

Cup-and-Handle Formation Signals Higher Gains

Another bullish indicator has been spotted by chartist AltcoinGordon, who points to a classic cup-and-handle pattern on XRP’s daily timeframe. The cryptocurrency has entered the handle phase, where the price consolidates in a narrow band following a U-shaped recovery.

A decisive move above the neckline at around $3.80 could confirm the pattern and pave the way for stronger gains. Based on technical calculations, the projected target lies near $5.80. That would represent a rise of nearly 90% from current prices, fuelling optimism among traders betting on a sustained uptrend.

Risks of Deeper Correction Remain

Despite the bullish technical signals, XRP’s short-term outlook hinges heavily on whether the $2.95 support can hold. Should the price break below this threshold, analysts warn of the risk of a larger pullback.

Harkishun suggests that such a decline could complete a “WXY correction” – an Elliott Wave pattern describing a prolonged, three-wave downturn. In this case, XRP might extend losses toward $2.40.

The $2.40 level carries historical significance, as it saw heavy trading activity during 2020 and 2021. It also coincides with the 200-day exponential moving average, providing an additional layer of technical support. In a bearish scenario, many traders expect this zone would serve as the next cushion where buyers could attempt to stabilise the market.

Outlook

The coming days are expected to be critical for XRP as it hovers around the make-or-break $2.95 mark. Analysts remain divided between the potential for a bullish breakout toward $4.40–$5.80 and the possibility of a correction to $2.40 if support gives way.

For now, the token’s struggle to reclaim the $3 psychological threshold underscores the uncertainty facing investors. Traders will be closely monitoring whether momentum returns to the upside or whether XRP slips into a longer consolidation phase.

Leave a Reply