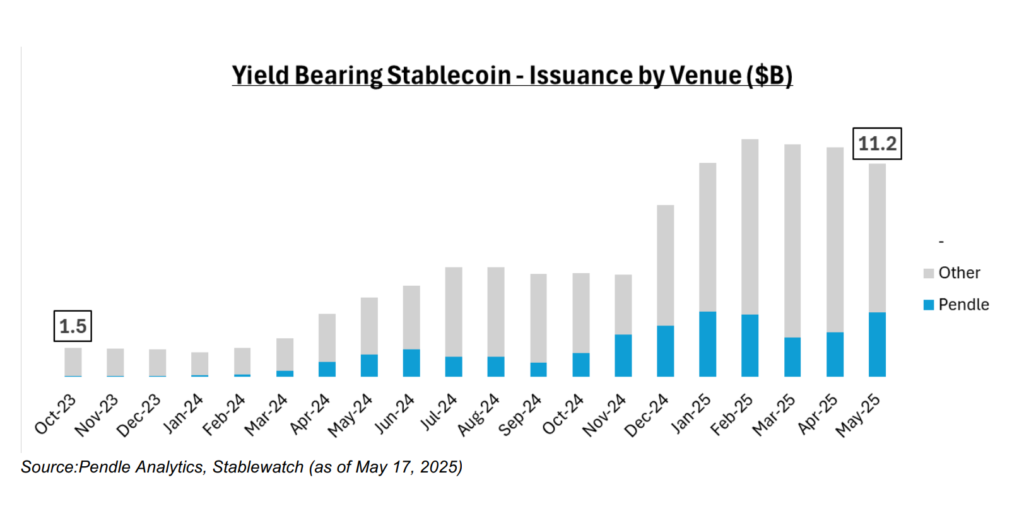

Yield-bearing stablecoins have rapidly gained traction in the crypto sector, soaring to $11 billion in circulation and now making up 4.5% of the total stablecoin market. This marks a substantial rise from just $1.5 billion and a 1% market share at the beginning of 2024, fuelled by increasing demand, shifting investor preferences, and greater regulatory clarity in the United States.

Pendle Emerges as Market Leader

One of the primary beneficiaries of this trend is Pendle, a decentralised finance (DeFi) protocol that enables users to lock in fixed yields or speculate on variable interest rates. Pendle now commands 30% of the total value locked (TVL) in yield-bearing stablecoins—roughly $3 billion—according to a report shared by the company.

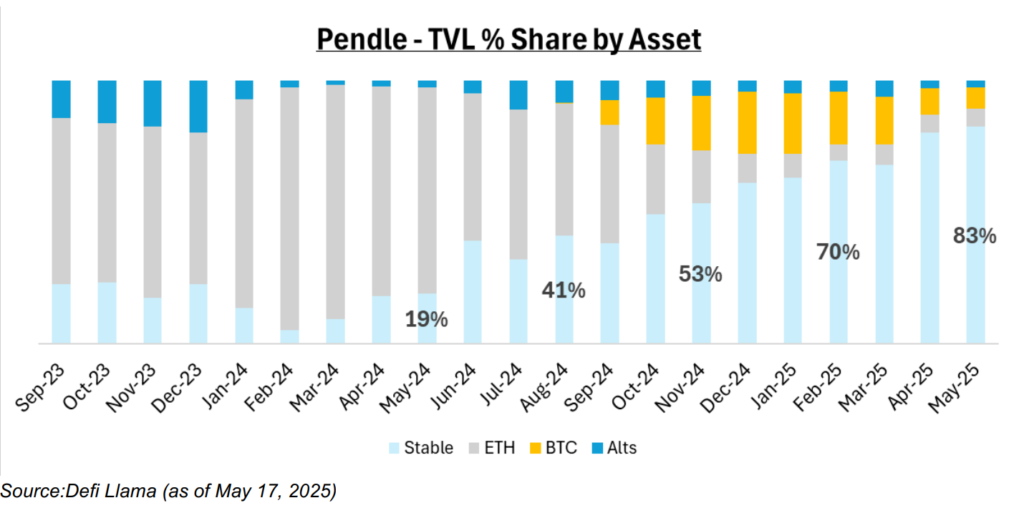

Overall, Pendle’s TVL has grown to $4 billion, with stablecoins comprising 83% of this figure, up from less than 20% a year ago. Meanwhile, traditional assets such as Ether (ETH), which historically made up 80% to 90% of Pendle’s TVL, now account for less than 10%.

Traditional Stablecoins Miss Out on Billions in Yield

Conventional stablecoins like Tether’s USDt (USDT) and Circle’s USD Coin (USDC), which together have over $200 billion in circulation, do not pass on interest to holders. With US Federal Reserve interest rates hovering at 4.3%, Pendle estimates that holders of these stablecoins are missing out on over $9 billion in annual yield.

This missed opportunity has fuelled the popularity of yield-bearing alternatives, offering both institutional and retail investors a way to earn passive income on their crypto holdings.

Regulatory Clarity Boosts Sector Confidence

The surge in yield-bearing stablecoins comes amidst growing regulatory clarity under the administration of US President Donald Trump. In a landmark move earlier this year, the US Securities and Exchange Commission (SEC) classified yield-bearing stablecoins as “certificates” rather than banning them, placing them under securities regulation.

This classification requires issuers to meet specific conditions, including registration, investor disclosures, and transparency obligations. Proposed legislation, such as the Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act and the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, signals a supportive environment for continued stablecoin innovation.

Market Poised for Major Expansion

Pendle anticipates that the broader stablecoin market could double in size, reaching $500 billion over the next 18 to 24 months. Within this growth, yield-bearing stablecoins are projected to capture 15% of market share—equivalent to $75 billion in issuance. This would represent a nearly sevenfold increase from the current $11 billion.

Ethena’s USDe stablecoin currently represents approximately 75% of Pendle’s stablecoin TVL. However, new players such as Open Eden, Reserve, and Falcon are gaining ground. These entrants have increased the proportion of non-USDe assets from 1% to 26% in Pendle’s ecosystem over the past year.

Expansion Beyond Ethereum and New Use Cases

Originally focused on airdrop farming, Pendle has repositioned itself as a foundational infrastructure layer for yield markets in DeFi. The protocol is also expanding beyond the Ethereum network, with plans to integrate with upcoming blockchains such as Ethena’s Converge and existing protocols like Aave. Solana is also on Pendle’s roadmap for future support.

The broader DeFi space has seen rising interest in yield-generating strategies, particularly among institutional investors aiming to optimise returns on idle assets.

In line with this trend, on 19 May, Franklin—a hybrid cash and crypto payroll provider—launched “Payroll Treasury Yield”. This new product leverages blockchain-based lending protocols to help companies earn returns on their payroll reserves, further demonstrating the mainstream appeal of blockchain-powered yield strategies.

Outlook

With regulatory backing and rising user demand, yield-bearing stablecoins appear poised for continued growth. As traditional stablecoins remain yield-neutral, the market shift towards interest-generating alternatives could redefine how investors store and grow value in the decentralised financial ecosystem. Pendle’s strategic pivot and expanding partnerships place it at the centre of this evolving landscape.

Leave a Reply