Zcash (ZEC), the once-famed privacy coin, is flashing red-hot warning signs as on-chain data points to a speculative bubble larger than its 2021 peak. According to CryptoQuant’s latest analysis, ZEC’s current trading activity has reached “hyper-heated” levels, suggesting the asset could be entering an extreme distribution phase.

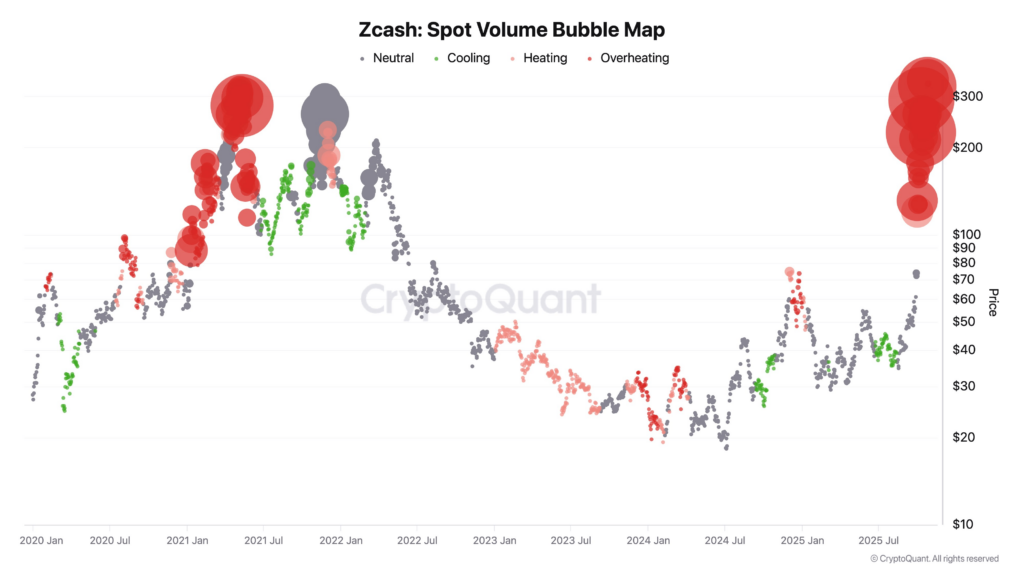

Ki Young Ju, CEO of CryptoQuant, sounded the alarm on X (formerly Twitter), urging caution among retail traders. “Sorry, but you’re retail if you’re buying Zcash now,” he posted, referencing a newly published Zcash: Spot Volume Bubble Map that visualises ZEC’s trading volume and price dynamics since early 2020.

The chart measures bubble formation by correlating price movement with spot trading volume. Each data point is represented by a circle, its size corresponding to total traded volume and its colour reflecting the rate of change, from “cooling” to “hyper-heating.” When price growth stalls amid record-high volume, it signals the late stages of a bull market, commonly known as the distribution phase.

Echoes of 2021’s Distribution Phase

The distribution phase marked the turning point of ZEC’s 2021 bull run, when prices climbed above $300 before collapsing alongside the wider crypto market. At that time, heavy retail inflows and token turnover among newer investors preceded a multi-month decline that wiped out much of ZEC’s gains.

CryptoQuant’s latest data shows that current trading volumes and bubble intensity far surpass the levels seen in that 2021 cycle. The pattern suggests a market once again driven by speculative momentum rather than sustainable demand or network fundamentals.

For context, ZEC’s price has rocketed over 750% in the last three months, reaching around $328 as of Tuesday, up from $308 when former BitMEX CEO Arthur Hayes predicted a $10,000 target for the coin. The sharp rally has fuelled an industry-wide debate over whether privacy coins are staging a long-term comeback or simply repeating history.

Speculative Mania Grips Privacy Coin Sector

ZEC’s resurgence has ignited renewed interest in privacy-focused cryptocurrencies such as Monero (XMR) and Dash (DASH), many of which have also recorded double-digit gains. Analysts attribute this trend to a mix of regulatory uncertainty, the ongoing global debate around digital privacy and social media hype led by high-profile crypto influencers.

However, the data suggests the move may be primarily speculative. CryptoQuant’s bubble map indicates that while trading volume has exploded, on-chain activity, such as active addresses and transaction counts, has not increased proportionally. This divergence is often a hallmark of short-lived, sentiment-driven rallies.

Analysts Warn of Potential Repeat Collapse

If the current cycle mirrors the structure of 2021, investors could be approaching a major inflection point. Ki Young Ju’s analysis implies that ZEC might soon face a correction phase as liquidity dries up and speculative buyers exit.

“History doesn’t repeat, but it rhymes,” Ju remarked, hinting that the size of the current bubble could amplify any subsequent downturn. The last time similar on-chain metrics appeared, ZEC lost more than 70% of its value within months.

For now, the data paints a sobering picture: the so-called Zcash bubble is not only back, it’s bigger than ever. Whether it bursts or evolves into a sustained market cycle may depend less on hype and more on whether Zcash can deliver renewed real-world utility in an increasingly regulated crypto landscape.

Leave a Reply