Zcash (ZEC) has rocketed to its highest level in more than eight years, overtaking Monero to become the world’s most valuable privacy-focused cryptocurrency. The token climbed over 45% in the past week, defying the broader crypto market downturn and reigniting investor enthusiasm for privacy-centric digital assets.

Zcash Defies Market Slump

While most major cryptocurrencies remained subdued following the failed U.S.-China tariff deal earlier this week, Zcash bucked the trend with a powerful rally. The token surged 7.6% in the last 24 hours to reach $388 on Friday, according to data from CoinMarketCap. With a market capitalization of $6.2 billion, ZEC has now surpassed Monero (XMR), which trades around $328.30, to become the leading privacy coin.

This surge stands in stark contrast to the overall crypto market, which has been struggling to find direction amid macroeconomic uncertainty. Bitcoin (BTC), for instance, continues to trade near $110,000, showing limited momentum as investors await clarity on global trade relations and monetary policy.

Rising Demand for Privacy Coins

The strong performance of Zcash and other privacy tokens reflects a growing appetite among investors for cryptocurrencies that enhance transaction anonymity. Privacy coins use advanced cryptographic methods to conceal details such as sender, receiver, and transaction amounts—features not available in transparent blockchains like Bitcoin.

By masking wallet addresses and transaction histories, coins like Zcash and Monero provide users with financial confidentiality, a feature that has become increasingly desirable amid tightening regulatory scrutiny. Analysts say this renewed interest signals a broader shift toward decentralization and personal data control in the digital asset space.

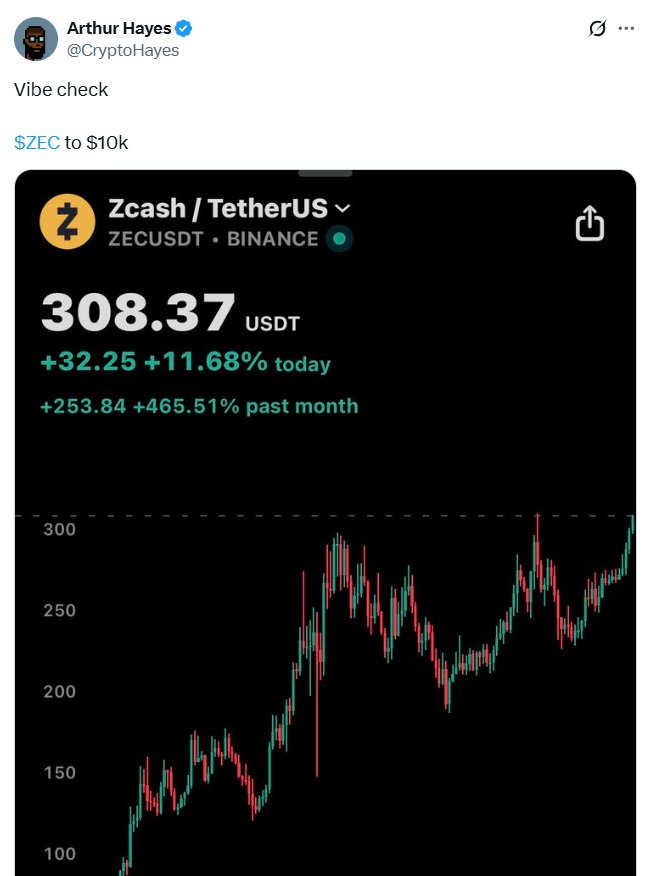

The Hayes Effect: $10,000 ZEC Prediction

Zcash’s latest breakout was fueled in part by a bold forecast from BitMEX co-founder Arthur Hayes. Earlier this week, Hayes predicted that ZEC could eventually rally to $10,000, sparking a wave of investor optimism. Within hours of his statement, Zcash jumped from $272 to as high as $355, marking the start of a sustained rally that carried it past $380 by the end of the week.

Hayes’s bullish outlook injected momentum into the market, drawing both retail and institutional attention. His prediction has been widely discussed across crypto circles, with some traders seeing Zcash’s strong fundamentals and limited supply as key drivers for long-term growth.

Whale Activity and Market Sentiment

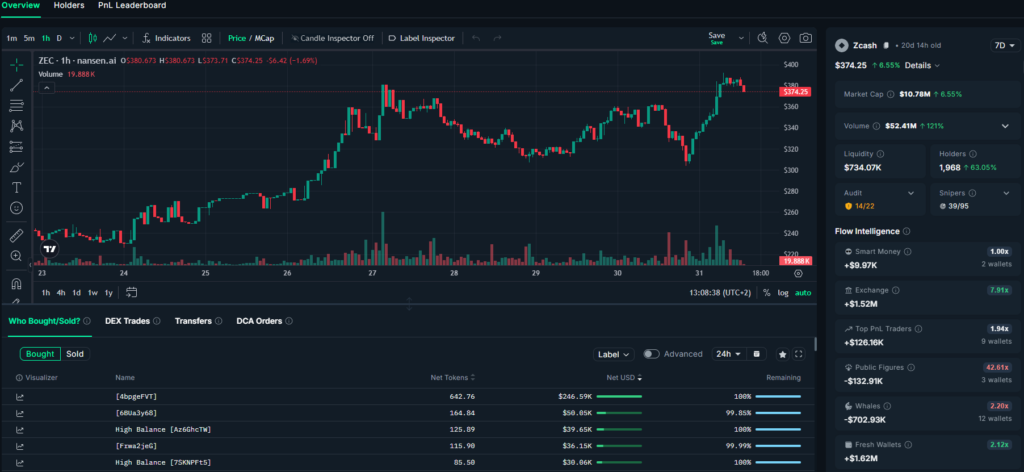

Despite the impressive price action, data suggests mixed behavior among large ZEC holders. According to analytics firm Nansen, the number of Zcash tokenholders climbed 63% over the past week to nearly 2,000 addresses. However, whale wallets—those holding large amounts of ZEC—have been selling into the rally, unloading roughly $702,000 worth of tokens during the same period.

This selling pressure from big holders has so far been absorbed by increasing retail demand, which has helped sustain the price uptrend. Market observers say such redistribution from whales to smaller investors could help stabilize Zcash’s market structure in the long run.

Community Reaction and Market Outlook

The sudden rise in ZEC’s value has drawn strong reactions from the crypto community. Simon Dedic, founder and managing partner at Moonrock Capital, noted that Zcash’s rally is remarkable given its market stature. “Crazy to see how $ZEC has pulled a 10x in just two months, completely decoupling from the market and ignoring overall sentiment,” Dedic said in a post on X. “This isn’t some minor token—it’s a multibillion-dollar asset, which makes this kind of performance even more impressive.”

Analysts believe that Zcash’s recent success could spark renewed debate around privacy in the crypto industry. Regulatory agencies have long expressed concern over the anonymity features of such coins, citing potential misuse for illicit activities. Yet proponents argue that privacy is a fundamental right and that these technologies can coexist with compliant frameworks.

Looking ahead, much will depend on whether Zcash can maintain its momentum amid shifting market dynamics. The $400 mark now acts as a psychological resistance level, and breaking through it could further validate Hayes’s ambitious target.

A Turning Point for Privacy Coins

Zcash’s comeback highlights the resilience of privacy-focused projects in a market increasingly dominated by narratives around transparency and regulation. As investors seek ways to protect their financial data, privacy coins appear to be regaining relevance after years of subdued performance.

While it remains to be seen whether ZEC can sustain its newfound dominance, its recent rally underscores one thing: the demand for privacy in digital finance is far from fading.

Leave a Reply